Most students are of course aware of the traditional fiscal policy – where the government manipulates taxes and its expenditure to influence the economy’s aggregate demand.

What most of them do not apply in their essays, is the use of fiscal policy as an automatic stabiliser.

We find this regrettable as fiscal automatic stabilisation is a powerful evaluation point that can be used in exam essays, so do read on!

Why is “automatic” and stabilising” desirable?

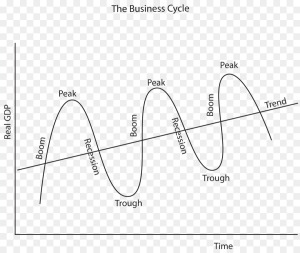

In a typical economy, the flux of the business cycle means that the performance of the economy fluctuates from time to time:

This is undesirable in general because the economy will suffer from inflationary pressures during the boom phase, and then deflationary pressures during the bust phase.

At the macro level, it becomes difficult to achieve consistent outcomes in the country’s demand-management policies.

Imagine yourself as the economic advisor to a country. You have forecast a general weakening of aggregate demand due to various economic factors such as slowing global demand (if your aggregate demand is reliant on exports), or a generally pessimistic business outlook.

The go-to solution all students are aware of is to utilise demand-management policies. And in this example, expansionary demand-management policy would be employed, to strengthen aggregate demand.

In practice, the use of demand-management policies can be problematic:

- The government may not have the most accurate and/or up-to-date data on the economy, which causes inaccurate estimates and forecast.

- Consumers and businesses do not often respond instantly to stimulus, resulting in policy lag. In extreme cases, significant response can occur as the economy begins to turnaround, resulting in overshooting and deeper troughs and peaks instead.

As a result, deliberate and conscious demand-management policies may end up like this rather:

In addition, there are costs to interventions with frequent adjustments, such as unpredictability, distractions from other economic issues and the higher effort to constantly monitor the economy.

This makes the case for a demand-management tool that is both automatic and stabilising in nature highly attractive to policymakers.

How does fiscal automatic stabilising works?

There are 2 key tools used to achieve it:

- Taxes

- Welfare spending

Returning to our earlier scenario of weakening aggregate demand, the general result of that would be lower income and spending power of consumers (which reduces corporate income).

The amount of taxes paid to the government (assuming the tax is at a fixed rate on the income) would be reduced, lessening the impact of the weaker aggregate demand as disposable income falls less than proportionately.

Let us illustrate this using a numerical example:

Disposable Income = Gross Income – Tax Paid

Let us assume that your original income is $1000, and the prevailing tax rate is 10%. Therefore the amount of tax paid is $100 and your disposable income would then be $900.

With a recession however, your income was cut to $800. The amount of tax you will pay is accordingly reduced to $80, and your disposable income reduces to $720.

As can be seen, without the presence of taxation, the reduction to disposable income ($200) as a result of the recession, is more than if there was taxation ($180).

The reason becomes clearer when we re-write the above equation in terms of change:

⃤ Disposable Income = ⃤ Gross Income – ⃤ Tax Paid

As can be seen, the presence of an income tax is stabilising by nature as it lessens the impact of a reduction to gross income on the disposable income. Furthermore it is automatic as well in that it did not require deliberate government intervention.

A similar concept can be applied with regards to welfare spending. For example, during the recession, unemployment would increase, resulting in an increase in dispensation of unemployment benefits.

Thus during a recession, fiscal spending automatically increases, which has a stimulating effect on the weakening aggregate demand. The net effect would then be similar to the case of taxes discussed earlier.

Why discuss about fiscal automatic stabilisation at all in essays?

Because fiscal automatic stabilisation yields another point in favour to the use of fiscal policy by policymakers.

In essays in particular, where the evaluation of fiscal policy is required, students may point out that the presence of taxes and welfare spending has a generally benign stabilising effect on the economy.

So go ahead – use fiscal policy as an automatic stabiliser in your exams!

Lend your support!

I hope that you have enjoyed reading this article of mine. I am giving my time to sharing my knowledge and every bit of support means a lot to me! Do drop me a comment or share this article on social media with your friends.

To find out more about my services as a JC Economics tutor, visit my website here.

Nice post. I learn something new and challenging on blogs I stumbleupon on a daily basis. It’s always interesting to read through articles from other authors and practice something from other web sites.

LikeLike

My spouse and I stumbled over here by a different page and thought I might check things out. I like what I see so now i am following you. Look forward to looking over your web page again.

LikeLike