Libya, Mali, Chad, Burkina Faso, Niger.

What do these countries have in common?

If you had answered that they are African nations, you are right!

But according to Trading Economics, these are also some countries that are experiencing high deflation rates at the moment.

Coincidence? Perhaps.

We know what is deflation – so I won’t bore with “what is deflation” and “how to measure deflation”, stuff like that. If you don’t already, you can read more about it at Wiki.

Instead, I have found that students tend to struggle a little in understanding why mainstream discussions deem deflation as particularly problematic. This is likely because:

- Deflation tends to be taught as a secondary concept to its more well-known counterpart, inflation.

- When prices are dropping, why should we, as consumers, complain?

True. “A” level questions tend to be more biased in asking questions related to inflation rather than deflation. But that doesn’t mean deflation doesn’t appear at all.

So, to help you out, I have compiled 4 quick reasons why deflation is deemed bad with elaborations which are sufficient for the “A” level exams. So do read on!

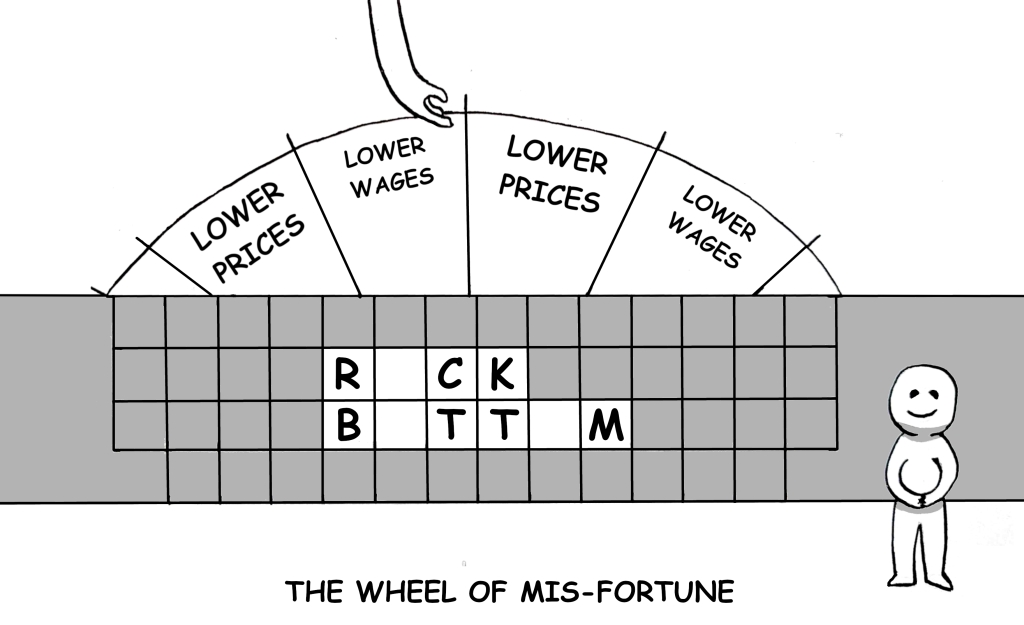

1. Consumption delay

During deflationary periods, consumers expect during times of deflation that prices will get lower with time.

Rational behaviour assumptions predict that consumers will slow their consumption in anticipation of cost savings from future lower prices.

Unfortunately, especially in the case of deflation driven by deficient demand, withholding consumption has the effect of reducing the aggregate demand, which will further weaken economic growth and fuel further deflationary pressure, in a vicious cycle.

In addition, reducing consumption also reduces revenue to producers, who may in turn be forced to reduce wages, or layoff workers.

As the labour market weakens, consumers (workers) may also be forced to cut back on consumption as disposable income falls, which as you might guess, fuels the deflationary cycle even further.

2. Real-wage unemployment

As the aggregate demand weakens continually due to the deflationary cycle, economic growth and employment level suffer as the aggregate demand shifts further from full production level (i.e. full employment).

The nasty effects of poor economic growth and high unemployment should be well-understood by students, so I will not be elaborating here, because that is not all I have to say.

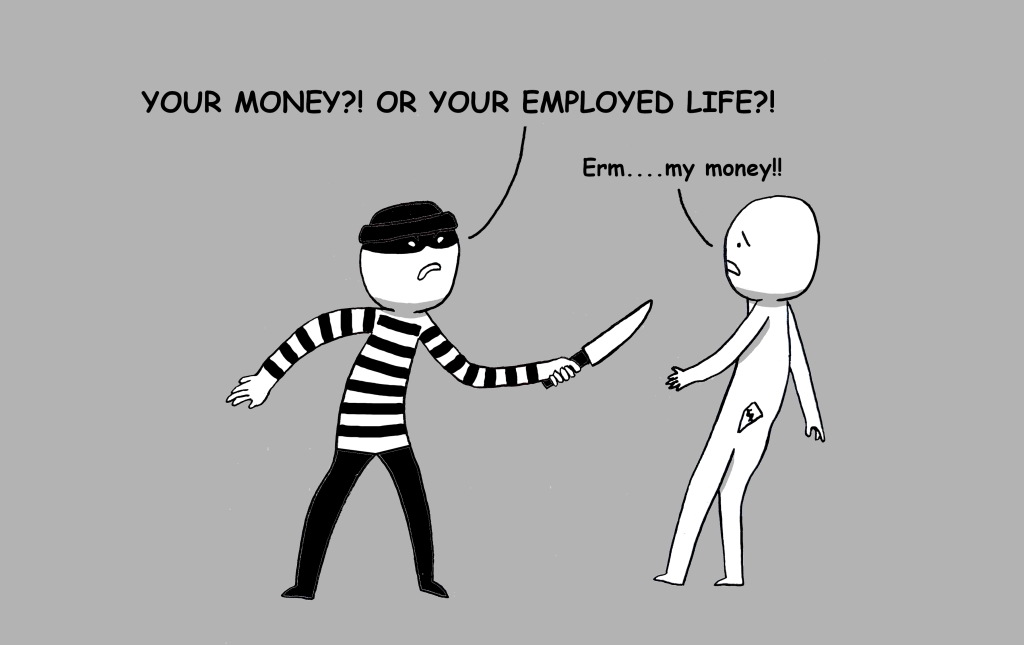

What I am about to point out is that: Deflation causes real-wage unemployment.

To understand this, we need to know how to derive real wages, which is basically the actual purchasing power of the consumer, as opposed to nominal wages (which does not take into account price changes).

Real Wage = Nominal Wage / CPI

Where CPI means Consumer Price Index.

Using a quick rate-of-change conversion trick to the above formula, we can see the effects of deflation on real wage:

Rate of △ Real Wage = Rate of △ Nominal Wage – Rate of △ CPI

So when CPI falls (i.e. there is deflation), the rate of change in real wage is actually positive even if there is no change to nominal wages.

During a deflationary cycle, labour demand weakens and therefore the equilibrium nominal wage should fall. However, resistance to wage-cuts from workers may cause the nominal wage to “get stuck” at the same level, causing real wages to rise as the CPI falls past the base index.

A surplus in labour therefore results, which causes unemployment to worsen.

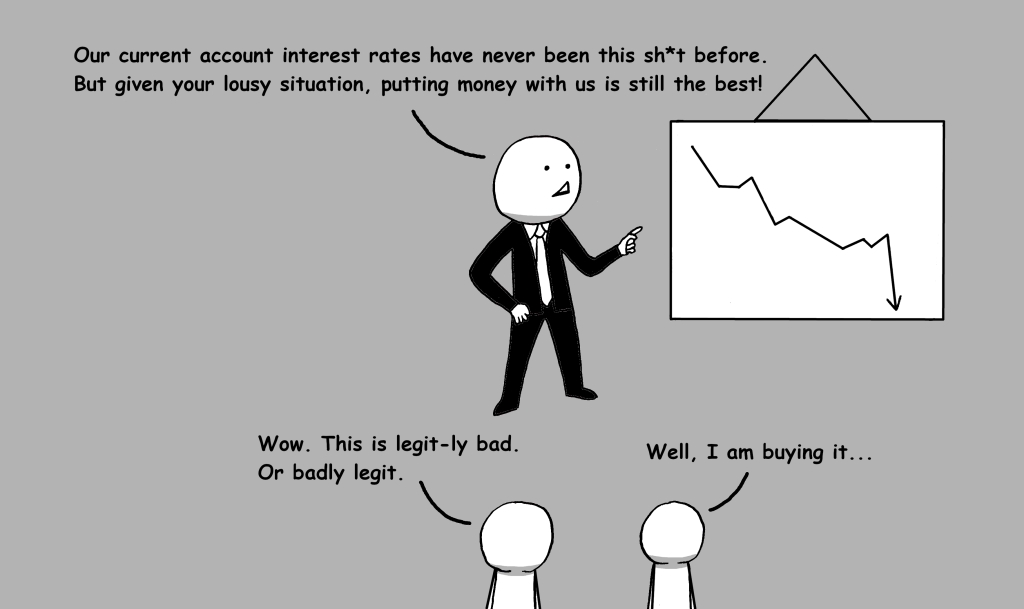

3. High real interest rates

A general financial advice often heard involves investing your cash in financial instruments because letting it sit in the bank’s current account will cause its value to erode through inflation.

To see why, we derive the real interest rate (which measures the “actual” effect of the nominal interest rate after considering price changes):

Real Interest Rate = Nominal Interest Rate – Inflation Rate

So the general financial advice on investing your cash rather than letting it sit in the bank account occurs because the accruing current account interest rate tends to be low and can be exceeded by the inflation rate, causing the real interest rate to be negative.

But when the inflation rate is negative, which happens during deflation, the real interest rate is actually higher than the nominal interest rate.

As we all know, higher real interest rates exert a contractionary effect on the economy – which is hardly what you want in a deflationary environment and could worsen the situation in the case of a demand-deficient deflation.

Even worse, deflation can render monetary policy useless by causing the economy to enter a liquidity trap.

A liquidity trap, in the Keynesian monetary model, refers to a situation where interest rates could no longer fall below, because the liquidity preference has become infinite (i.e. people are hoarding cash rather than investing because the interest earned on investments are simply too low).

When an economy is in the liquidity trap, expansionary monetary policy becomes useless because interest rates cannot be lowered further even with large injections to the money supply.

When deflation occurs, it becomes possible for the real interest rate to remain relatively high even with low nominal interest rates, making it easier for the liquidity trap to be reached, blunting the effectiveness of monetary policy.

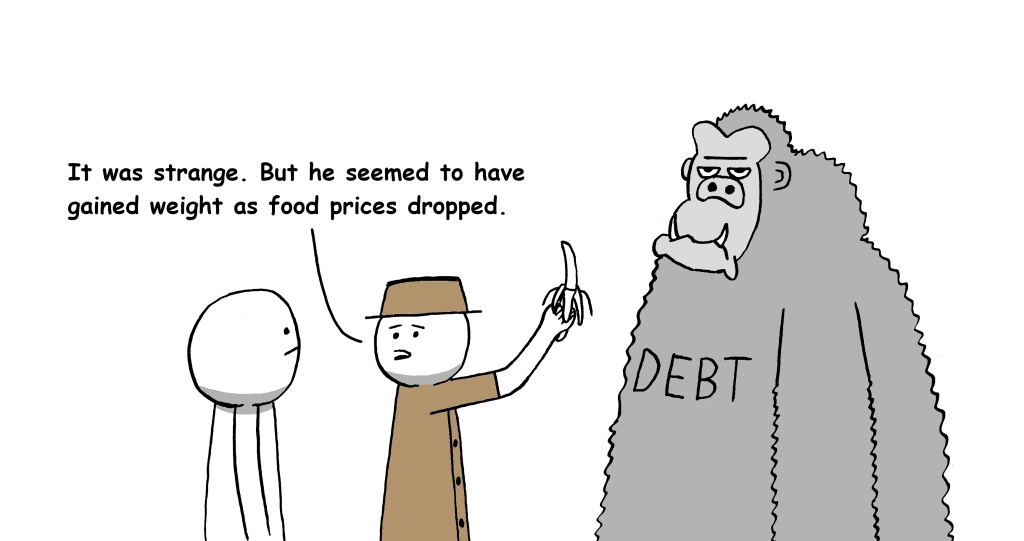

4. Debt burdens worsen

Let’s say you loaned a good friend $100 at no interest, to be paid back in a year’s time.

That year however, the inflation rate was negative. So when your friend has duly returned you the $100, that same amount of money is now worth more in real terms (i.e. can purchase more stuff).

So if you were a lender, you would prefer a deflationary situation, and vice versa if you were the borrower since you would now have to pay more back in real terms.

Consequently, a deflationary situation increases the overall debt level in real terms, which causes the debt default level to rise as fewer debtors are now able to service the debt.

As a result, bank assets fall in value as more people default on their loans, and also the value of their collateral fall due to deflation.

In milder form, deflation causes the availability of funds for investments will be reduced, which reduces future economic growth. In more extreme form, deflation may cause bank insolvencies, which may have a contagion effect to the banking industry and destabilise it further.

At the national level, if the government had borrowed money from its citizens, or from foreign countries, to cover its fiscal deficit, domestic deflation will mean the government will now have to pay more in real terms.

Again, in milder form, having to pay more in real terms will mean higher opportunity costs (e.g. the increase in real cost of debt reduces available funds for defence or education). In more extreme form, the government may actually be forced to default on its loans, which is very much a “god-forbid” situation since it allows its debtors, domestic and foreign, greater political leverage.

And there you have it! 4 bite-sized reasons for “A” levels, on why deflation is generally viewed dimly.

Support Me

I write because I am compelled to share what I know, and what I have learnt in turn, from the community.

If you liked reading this article, why not support me by sharing it with your friends, and/or subscribe to my articles to get them hot from the oven!

To those who have subscribed to my articles, I am greatly humbled by your support. People like you are a great source of motivate for me to write more, and better.