COVID-19 is now everywhere as far as commentaries are concerned.

By now, there is no need for me to explain too much about its multi-faceted impacts to our lives, ranging from inconveniences, disruptions, and actually falling sick (yes, even the UK prime minister is not invulnerable).

Amidst the havoc wrought by COVID-19, there was another major upheaval to markets when Saudi Arabia and Russia agreed to disagree over the next set of production quotas for the OPEC+ members.

Long story short, as expected from the OPEC playbook, the Saudis pushed for oil supply cuts to prop oil prices up in the face of the diminished oil demand.

Things went a little different this time tough, when the Russians resisted as they wanted to avoid “helping” major rivals, American shale oil producers, who have been gaining market share.

The Saudis then decided to go apesh*t, and increased oil production instead of cutting it. Ostensibly, to show the Russians who’s their daddy.

Nobody quite saw this coming and the result was a free-fall in oil prices, dubbed “Black Monday“:

So that’s the business/finance and geo-political side of matters. For most Singaporeans though, only one thing seemed to matter here: Consumer prices.

As oil is a raw material for the production of various goods such as plastics, and also an input to motor vehicles, electricity generation, airplanes, the typical consumer would be expecting prices to fall to varying degrees across the board.

In particular, oil is more directly observable as a consumer good in the form of petrol. So naturally, all eyes in Singapore, were on average retail petrol prices to fall.

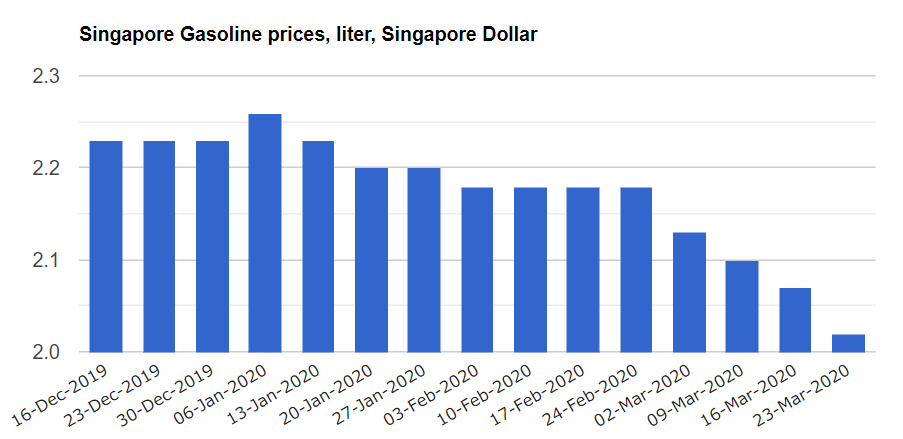

And happened it did, although it appeared somewhat underwhelming, falling “only” from ~S$2.15 to ~S$2.02:

Must be some business conspiracy?

There has long been a suspicion in Singapore that in many cases, “price levels” would have been a suitable answer to the age-long riddle (pun-intended) that goes: What goes up, but never down?

While clearly retail petrol prices have indeed come down in the latest episode, even Minister of Parliament, Ms. Lee Bee Wah, couldn’t resist asking, yet again (in exact words):

The Minister for Trade and Industry in light of the plunge in crude oil rates

(a) whether current retail prices at petrol pumps reflect this trend; and

(b) if not, whether the Ministry will implement measures to ensure petrol companies adjust prices accordingly.

This question, was reportedly answered by Dr. Tan Wu Meng in Parliament, that:

Retail petrol prices here have fallen with the steep decline in crude oil prices from US$66 a barrel to US$34 between Jan 2 and Mar 9.

And accordingly:

“The listed price of Octane 95 petrol fell by 20 cents per litre, with a slight lag of six days,” he said. “This represents a pass-through of over three-quarters of the decrease in crude oil price.”

In addition:

Dr Tan noted that crude oil has to go through refining and processing before it becomes petrol at the pumps. “There will also be operating costs, taxes, duties and land costs on the one hand, as well as discounts and rebates on the other hand,” he added.

So, a pass-through rate of about 70 per cent is typical, Dr Tan said, citing an in-depth study on retail petrol prices in 2017 by the then Competition Commission of Singapore.

So basically Dr Tan was saying yes, the petrol retailers have been reasonably passing the cost savings on to consumers.

Assuredly though, this wouldn’t satisfy ardent believers of the theory that petrol prices are more likely to go up, than go down.

After all, sekali it is in fact part of a bigger business conspiracy to keep the rich richer, and the poor poorer?

Rockets and Feathers

Regardless of the various speculated intents and reasons, many members of public’s attest to the observation that the price of a product tends to rise more readily with a rise in factor costs, than fall with a fall in factor costs.

As with most Economic observations, there is a formal label to that: Asymmetric Price Transmission.

And an informal one too: Rockets and Feathers, which references the vastly different rates at which both kinds of objects move through air.

Is it empirically true? What is the ground situation of the retail petrol market in Singapore?

CCCS did a study on retail petrol prices in 2017.

Well, Dr Tan did mention in Parliament that he was citing a 2017 study by CCCS (Competition and Consumer Commission of Singapore) – so that piqued my interest and I downloaded the report here to read it.

It turned out that the report was a broad-based one that reported on key observations about the retail petrol market in Singapore, rather than a hypothesis-driven study (i.e. one that answers a specific question).

Of course for the sake of answering to this article that I am writing, I will zoom in on the relevant portions of the report. But I actually read the report from beginning to end (it is only 30-odd pages), and it made for a rather interesting read.

Amongst other key findings within the report, I found that this pass-through rate of 0.7 was actually measured between the MOPS (upstream), and retail petrol price (downstream).

Now if you want to know how a good essay should be written in the exam, this report is gold standard (and we should expect no less from CCCS!).

A couple of short explanations cleared the sentence above quickly:

- MOPS refers to Means of Platts Singapore – The average of a set of Singapore-based oil product price assessments published by Platts, and which reflects the price at which petrol retailers purchase refined wholesale petrol from the refineries.

- Pass-through refers to the percentage of an increase (or decrease) of cost that is passed on to consumers through changes in listed and effective price.

Interestingly, Dr Tan had remarked in the Parliament that:

Retail petrol prices here have fallen with the steep decline in crude oil prices from US$66 a barrel to US$34 between Jan 2 and Mar 9.

And:

“The listed price of Octane 95 petrol fell by 20 cents per litre, with a slight lag of six days,” he said. “This represents a pass-through of over three-quarters of the decrease in crude oil price.”

Some math would quite easily show a pass-through of roughly 0.7 as well, between crude oil prices and retail petrol prices (note that crude oil price is measured per barrel, whereas retail petrol price is measured per litre).

Interesting coincidence or in fact structural? Perhaps we might uncover some insights in the coming articles.

These will be written as part of this multi-part series and I hope you will stay with me throughout.

Appreciate you sharing, great article post.Really looking forward to read more.

LikeLike