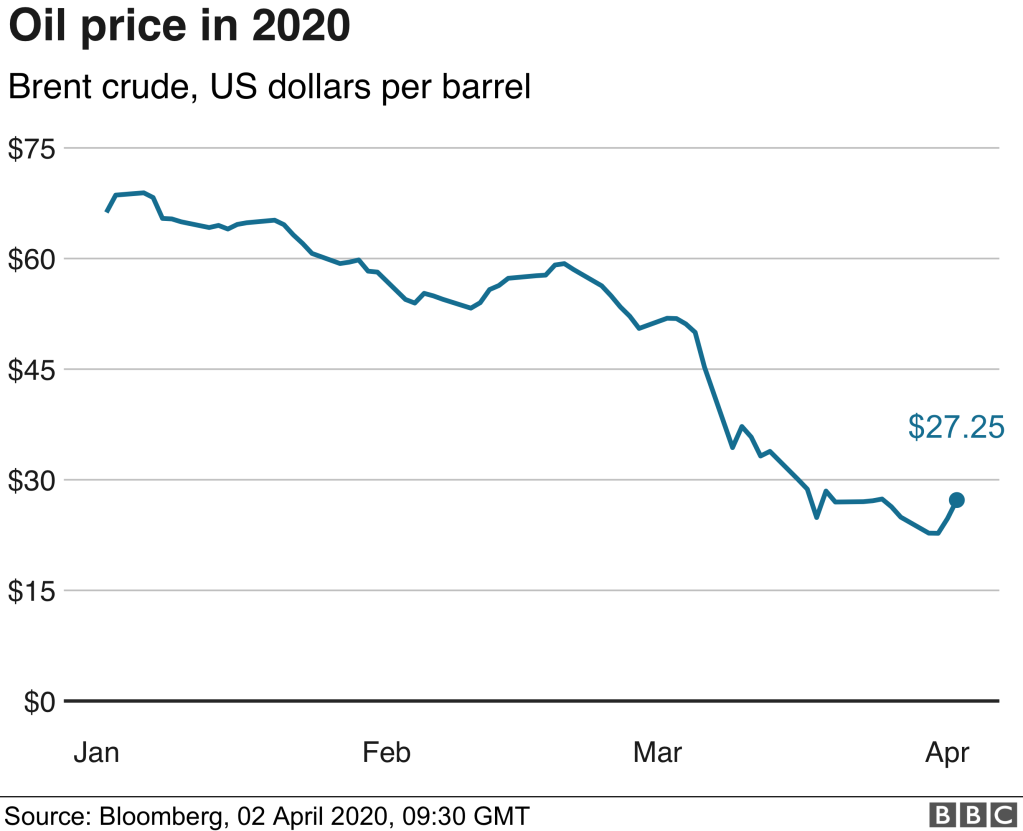

It has been roughly 2 weeks since I started on this latest mini-series about retail oil prices in Singapore, which was sparked by the oil glut caused by conflict between the Saudis and the Russians.

What has changed since?

Apparently nothing much. On a day or two, oil prices went up on slivers of good news, on other days, prices slumped instead.

You know things have sunk very low when the record one-day rise in crude oil price of 20% recorded earlier in the week was actually an increase of “only” $4 – $5.

Previously…

I gave a brief background to the motivation of this mini-series – how many Singaporeans believed that retail petrol prices (amongst other goods), tend to have a Rockets and Feathers effect.

This refers to how prices tend to move up faster (like Rockets) than prices moving down (like – you got it – Feathers), given changes in upstream product prices (i.e. crude oil in this case).

The question never did die even after a study by CCCS (Competition and Consumer Commission of Singapore), and was even asked formally at Parliament by MP Ms Lee Bee Wah.

The answer too, was nothing new since that study by CCCS. Actually, Dr Tan Wu Meng, Senior Parliamentary Secretary for Trade and Industry quoted the report as response, so…really nothing new there.

Of particular interest however, was his (or CCCS’) observation that the pass-through ratio (i.e. the percentage of change in upstream price transmitted to the change in price of the good) is roughly 0.7, which he appears to see no particular concern.

The Dummies’ Explanation – Demand & Supply

Already, I can imagine some murmurs from consumers that this “isn’t right” and how cost savings for petrol retailers should be passed on to consumers lock stock and barrel, after “years of good times for them”.

But I am about to point out that actually some basic Economics should inform us on the reasons why Dr Tan appeared nonchalant (or some say uninspiring) about it.

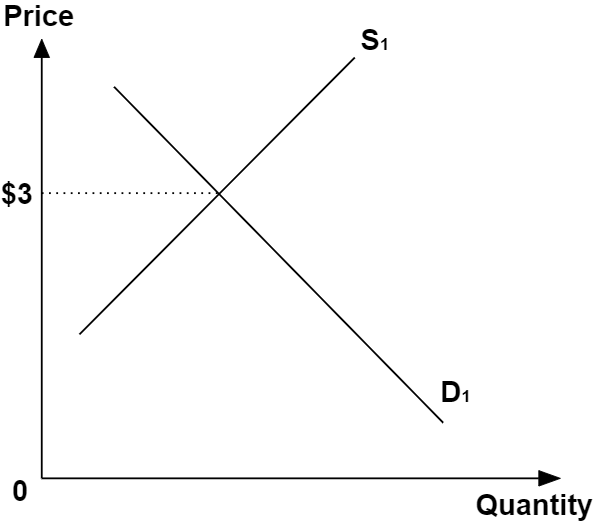

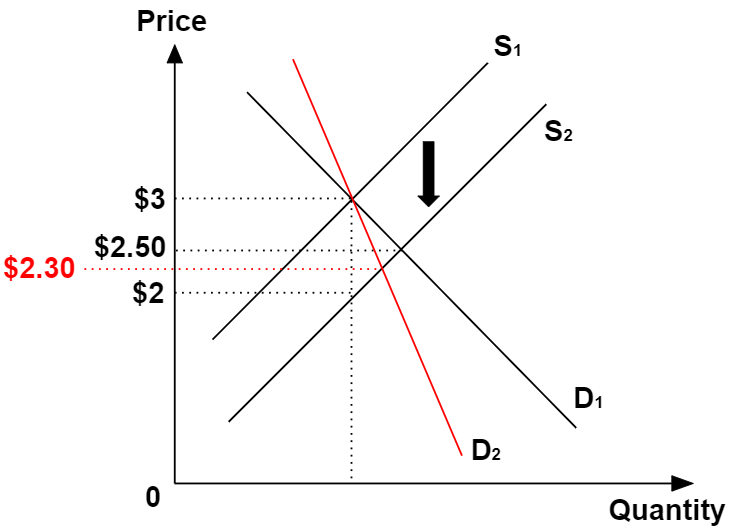

We start off with the standard demand-and-supply framework for retail petrol:

Let’s say petrol price was $3 per litre, which by the way would be outrageously expensive, but this is tongue-in-cheek for those who are quick to point out that petrol prices in Singapore are already expensive.

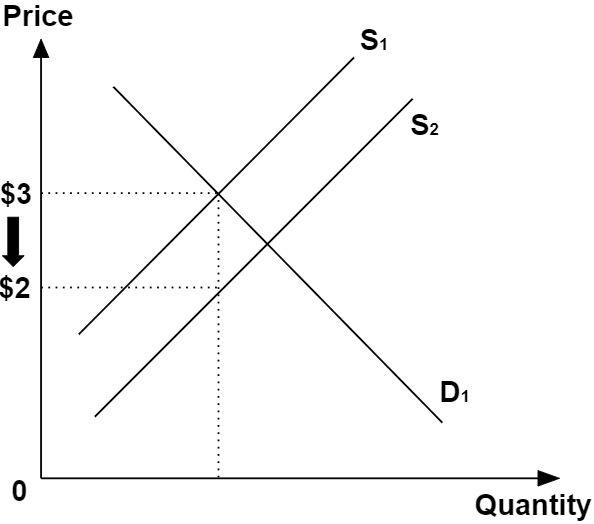

Now let’s introduce a rather arbitrary, but less-than-bonanza, fall in the cost of (wholesale) petrol to petrol retailers of $1 per litre, for every unit of oil sold (i.e. a parallel downward shift of the supply curve S1 to S2 by $1).

Economists, budding or pro, can probably see where this is going already: The market price for petrol falls less than a dollar instead.

Obviously this is no Eureka moment – the demand-and-supply model may have predicted the outcome to the movement in retail petrol prices in response to a fall in crude oil prices, but it explains zilch beyond that.

There are many explanations out there that I would like to share with you, but they deserve a separate article altogether – hence the need for a mini-series.

Price Elasticity of Demand (PED).

As the Economics text across Singapore schools (and probably the world too) reads: The Price Elasticity of Demand refers to the degree of responsive of quantity demanded for a good, in response to a price change, ceteris paribus.

For the uninitiated, the the slope of the demand curve is a function of PED, because:

PED = (Q / △Q) / (△P / P)

△P / △Q = P / (Q * PED)

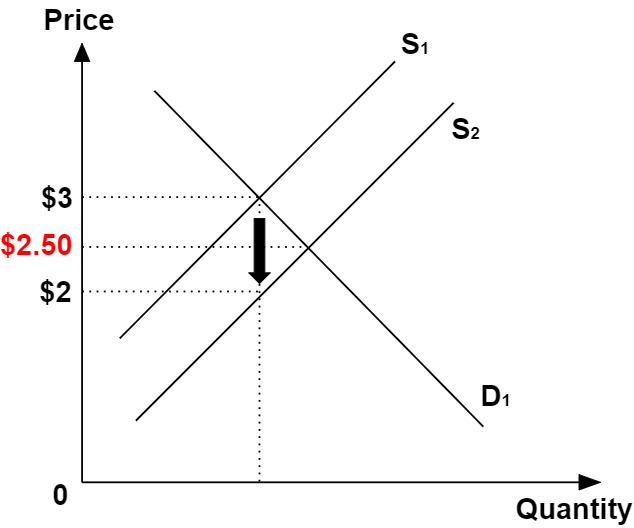

So the lower the magnitude of PED (more price inelastic), the higher the magnitude of △P / △Q (i.e. the slope of the demand curve becomes steeper). The slope of the demand curve in turn, determines how much the petrol retailer passes cost changes to the consumer.

CCCS’ report noted a pass-through rate of 0.7, which implies that for every dollar change to the wholesale price of petrol, we can expect a corresponding 70 cents change to the retail price of petrol.

With reference then to our demand-supply diagram, we can illustrate this by steepening the slope of the demand curve to D2 (in red).

So we can infer from the pass-through rate of 0.7 that the demand for petrol (in Singapore at least), is relatively price inelastic. This is in line with some common sense that we should have – petrol cars without petrol may as well not be called thus.

Interestingly, this PED slant to the demand-supply framework further lends some consistency to price changes, be it up or down (therefore invalidating the “Rockets and Feathers” hypothesis). And this was borne out by the CCCS report which noted exactly that.

A final note – Oligopolistic Competition

There was a somewhat understated observation from CCCS:

“CCS found that the magnitude of change in the retail petrol price is not significantly different depending on whether the MOPS price increased or decreased, and the change did not occur over a shorter time when the MOPS price increased (8 days) compared to when the MOPS price decreased (6 days)“

To recap a little from the previous post, MOPS refers to Mean of Platts Singapore, which is a price indicator for refined oil products in Southeast Asia.

While not sounding particularly significant, the second half of the statement suggests a slight reluctance to increase prices as opposed to decreasing prices by petrol retailers.

Notwithstanding the “conspiracies” about how CCCS is probably colluding with corporation big-wigs and what-not, this mild-sounding statement flips the long-standing suspicion that petrol retailers are always eager to pass on higher costs to consumers, completely on its head.

But why should the Economist in us be surprised? The oligopolistic theories of competition between firms actually predicts such an outcome.

In particular, it would appear that the petrol retailers engage in Bertrand competition, which is a type of firm competition model (for homogeneous goods – arguably such as oil here) where firms compete by setting prices rather than by setting output.

In such competition, firms have greater incentives to reduce price, rather than increase price, because the firm with the lowest price will actually attract ALL the consumers in the market (i.e. a winner-takes-all situation).

Obviously, this is an extreme prediction of the Bertrand competition model, which rests on several unrealistic assumptions.

Nonetheless, the CCCS’s observation about the slight reluctance to increase petrol price over decreasing prices does tie in somewhat to the drift of that prediction.

In addition, a logical way to avoid a “race to the bottom” price-war between petrol retailers is to differentiate their products, by perceived quality and price. These were duly noted by CCCS which reported that:

- A significant proportion of consumers tend to purchase petrol of higher grade than necessary for their cars.

- Prices are differentiated across petrol retailers through confusing discount and rebate schemes.

For the benefit of those who, like myself, do not own cars, a couple of screenshots should illustrate these well.

So while it is all good news that the “Rockets and Feathers” hypothesis can be laid to rest for the time being at least, there is some concern that consumers are not informed well.

And while CCCS clearly wasn’t going to point fingers in the report (hence the title “Market Inquiry on Retail Petrol Prices in Singapore”), there is little to doubt that this isn’t detrimental to petrol retailers.

Conclusion

So it appears that the “simpler” Economics theories I had utilised to explain Dr Tan’s muted response to such a heated topic says much, but yet not much at the same time.

As you would probably guess, the analysis I had done (I appeal to the serious Economists not to flame me) is indeed at an elementary level. Does that mean it has no merit? Of course not.

In fact, just knowing basic Economics should inform us that CCCS’ report is no fluke or conspiracy.

It is very much in line with what we can expect from the theoretical frameworks. At minimum, a sound understanding of the underpinnings (and limitations) of these theories ensures that you will not easily subscribe to all weird sh*t out there.

So that’s a wrap for the “Dummies’ Explanation” segment to this mini-series!

If you have found my articles interesting, do leave a comment below so we can connect. And remember to subscribe to my content here!