In the previous part to this mini-series, I had touched on some simple theoretical underpinnings to why the reduction in crude oil price would never be passed on wholly to consumers via the petrol retailers. You can read more about it here.

Of course there are other explanations too that are relevant – hence the need to write about it across multiple articles.

In particular, specialisations in economic activities, coupled with our increased interconnections within and beyond nations and regions, have seen supply chains becoming the norm for the production of many goods and services.

About supply chains.

A supply chain is commonly defined as a system of organizations, people, activities, information, and resources involved in supplying a product or service to a consumer.

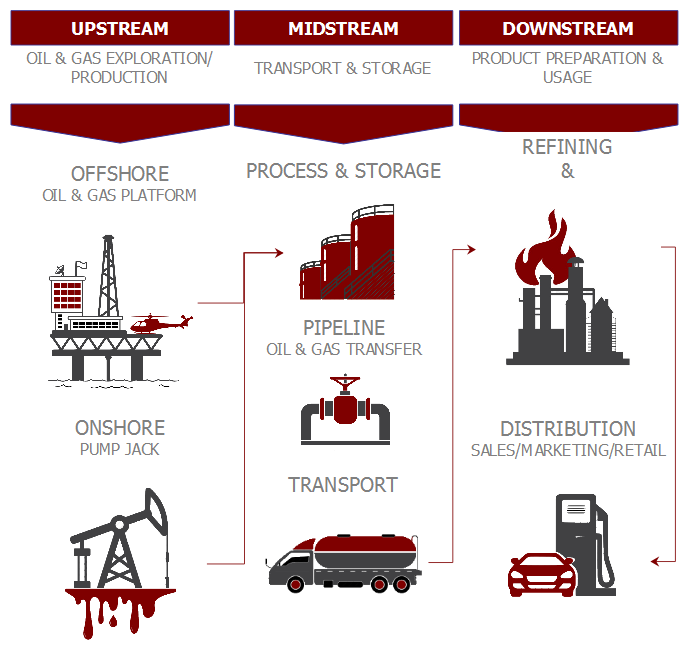

In the oil industry, the supply chain for petrol can be summarised as such:

As you can see in the infograph, there are quite a number of processes that oil undergoes, before it reaches our cars’ fuel-tank as retail petrol.

Each of these steps are handled by entities that specialise in that specific process. As you might imagine, oil extraction is vastly different from transportation and storage, which are in turn different from refining and retailing.

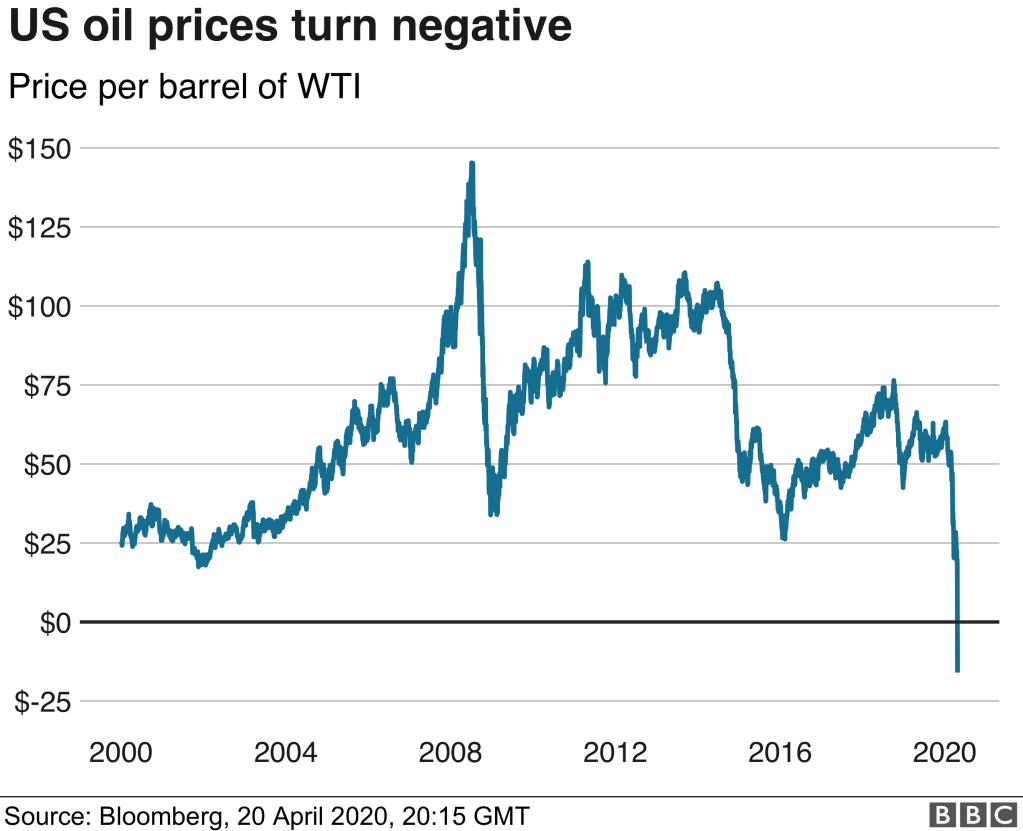

Incidentally, the supply chain is also a contributing factor to the WTI (West Texas Intermediate) oil price falling past $0, in the latest shocker to the ongoing oil price saga:

Going back to the supply chain infograph again, you can see that oil may not necessarily be extracted and then transported immediately for refining. In fact, more often than not, the crude oil gets stored before being refined for various uses.

Given that oil wells can’t be turned on/off like a switch easily, this is essentially for oil traders to buffer against supply (and demand) shocks to the oil market, so that:

- During times of low demand, oil drillers can still keep selling to traders with storage capacity.

- The opposite situation of higher demand can be mitigated by simply drawing down from stores of oil.

By design therefore, the midstream supply chain, in addition to transportation, is supposed to protect the industry against the whims of demand and supply.

However the collapse in oil demand caused by COVID-19 has been so deep, and exacerbated by the spat between Saudi Arabia and Russia (and OPEC in general), that oil storage has essentially run out and oil-drillers have little or no buyers for the crude oil.

In fact matters have gotten so serious, to the extent of oil-drillers selling crude oil at negative prices to get rid of the oil they are producing.

Price-setting in theory.

So the key takeaway is that like most other industries, the production of oil has its own supply chain.

When there are changes to the cost conditions to the upstream supply chain for a given product, the default expectation would be that these cost changes would percolate through the system, before reaching the end-consumer.

It should not be hard to read between the lines and see that:

- Lag-time can be expected for the pass-through of cost changes to the consumer (especially when goods are traded/procured with futures/contracts/options).

- Some “leakages” may be expected at each stage as the cost change gets passed on through the supply chain.

In particular, Point 2 is a likely candidate for explaining why the pass-through rate is seldom perfect.

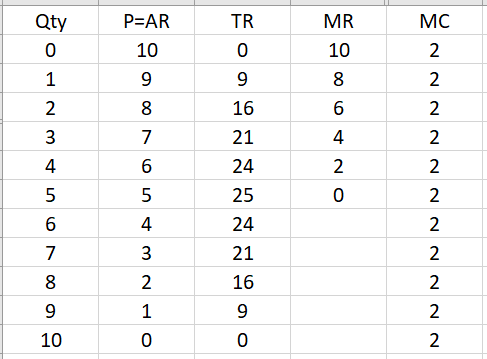

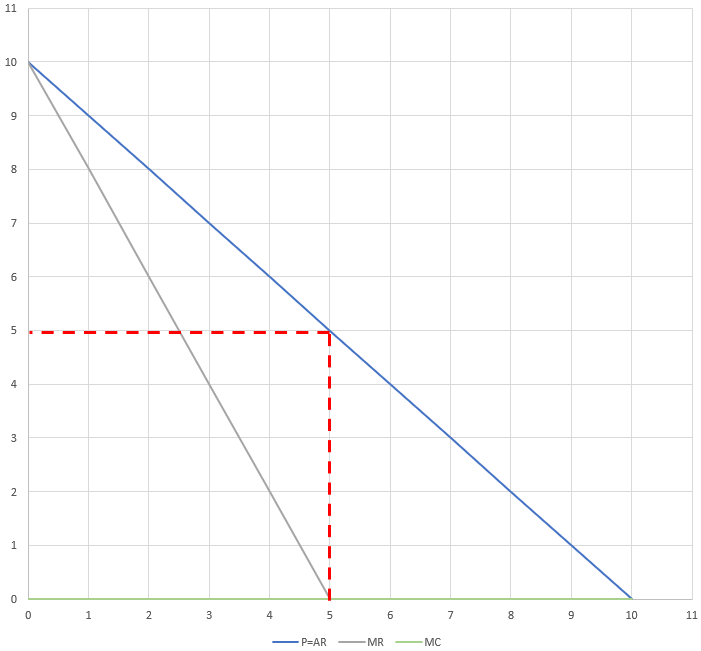

To see why, let’s look first at a price-setting firm taught by default in “A” levels. We begin by setting the following common parameters familiar to students, for a fictional retail petrol market.

P = Price

AR = Average Revenue

TR = Total Revenue

MR = Marginal Revenue

MC = Marginal Cost

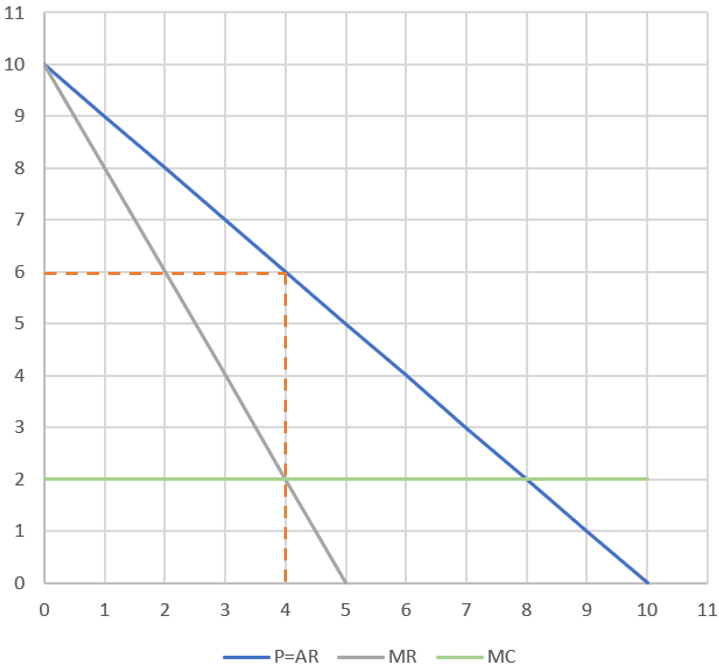

Plotting the P=AR, MR and MC curves will yield us the familiar firm cost/revenue graph. For simplicity, MC is assumed to stay constant as output increases here. For those who are interested in the derivation of MR, you can read an earlier article of mine here.

Now let’s introduce the happy situation (as perceived by end-consumers) of reducing the MC of petrol to $0 (a reduction of $2) per litre.

With the reduction of MC by $2 per litre, the new market price had dropped only by $1 per litre, representing a pass-through rate of only 50%.

This is very much in line with what I had discussed in the previous article – that the price elasticity of demand plays a major role in determining the pass-through rate. A perfectly price inelastic demand curve would theoretically allow a 100% pass-through rate.

Double Marginalisation

Obviously the theories we have done so far don’t answer many questions and are highly simplified. But the great news is that we can add layers of complexity bit by bit, and we can build a more structured knowledge base to cement our understanding.

One somewhat glaring omission is the lack of mention about middlemen sitting within the oil supply chain. Going back to the infograph, you could actually have at least 3 other stages to the supply chain before reaching the retail outlet:

- Extraction of oil

- Storage of oil

- Refining of oil

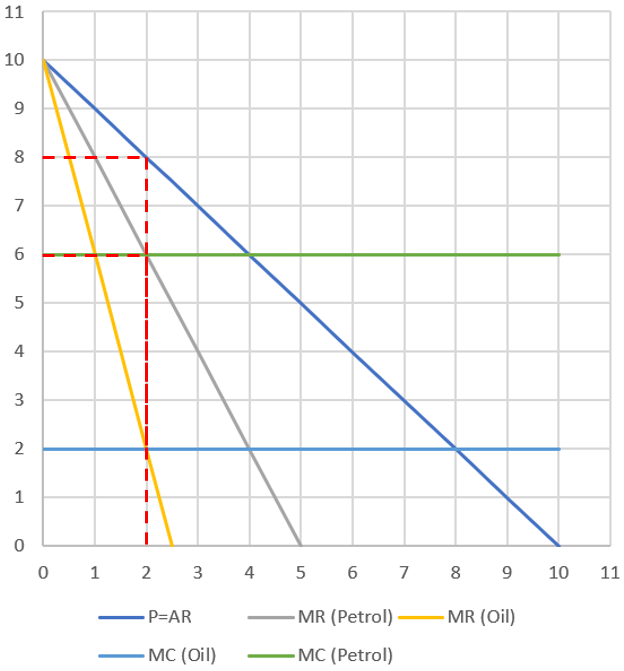

Let’s now assume that the original MC of $2 per litre actually applies to the oil refinery, which sells the refined petrol to the petrol retailer for sale to end-consumers.

To further simply matters, we shall further assume that refined oil is the only input required for petrol and that one unit of refined oil is required to produce one unit of petrol.

The first step to our analysis is to recognise that the MR of the petrol retailer corresponds to P=AR of the oil refiner. This is because the MC of the petrol retailer corresponds to the price charged by the oil refiner – recall our assumption that:

- Refined oil is the only input for petrol.

- The production relationship between refined oil and retail petrol is 1-to-1.

The oil refiner’s MR in turn is twice the slope of its P=AR line (starting from y-intercept of $10 per litre).

Observe that now, the oil refiner first sets its profit-maximising price of refined oil at $6 per litre. This then translates as the MC for the petrol retailer, which in turn sets its profit-maximising price of petrol at $8 per litre.

So the presence of having an additional production step lying outside of the petrol retailer, causes price to increase ($8 versus $6 per litre when the petrol retailer was assumed to face only its own MC).

The intuition behind it is simple. The additional production step in the oil supply chain has created an additional profit-margin to be factored into the final price of petrol, hence the formal name in Economics to this effect: Double Marginalisation.

Double Marginalisation decreases pass-through.

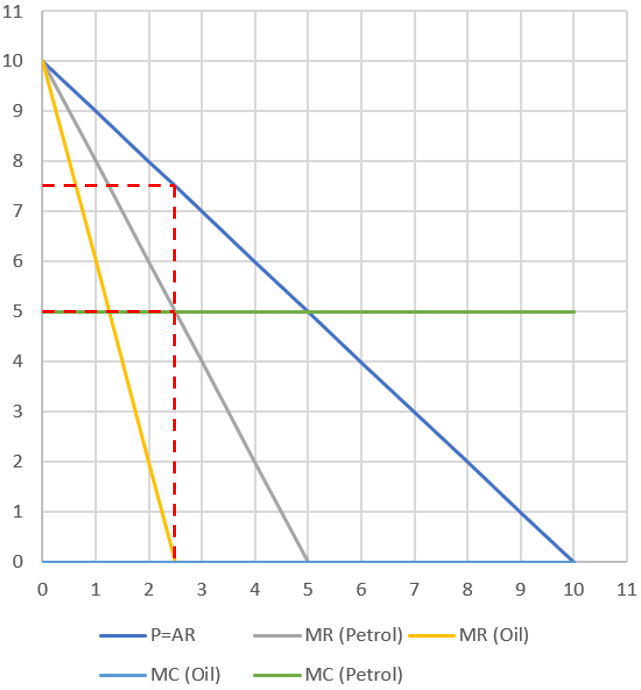

We can see this by doing a similar exercise to what we had done earlier: Reduce the MC of the oil refiner from $2 to $0 per litre.

So with the lower MC for oil refiners (a drop of $2 per litre to $0), the oil refiner lowers the profit-maximising price to $5 per litre to the petrol retailer, which in turn sets its profit-maximising price to $7.50 per litre.

So what did we get in this scenario? A “measly” $0.50 fall in petrol prices for an initial “large” $2 fall in the cost of refined oil!

It must be said that the overall pass-through rate for the petrol market ultimately depends on several other factors (e.g. the respective price elasticity of demands in the sub-market), but as we can see, the Double Marginalisation effect is not trivial, and given that there are more stages in oil production to contend with, it is safe to say that the pass-through rate may in fact be smaller.

Interpreting CCCS’ measured pass-through rate.

Quoting once again the findings of the CCCS report, which serves as our anchor point to this mini-series, the pass-through rate measured for the retail petrol industry is at ~70%, which all theories considered so far, suggests that it is actually quite high.

But there is a catch. The pass-through rate measured was between MOPS (Mean of Platts Singapore) and the retail petrol price.

To re-cap, MOPS refers to the price at which petrol retailers purchase the refined wholesale petrol from the oil refineries. But as we know, refining and retailing oil are considered downstream activities in the oil supply chain.

So the pass-through rate measured by CCCS doesn’t actually tell the full story about how cost changes are transmitted between crude oil (upstream) and retail petrol (downstream).

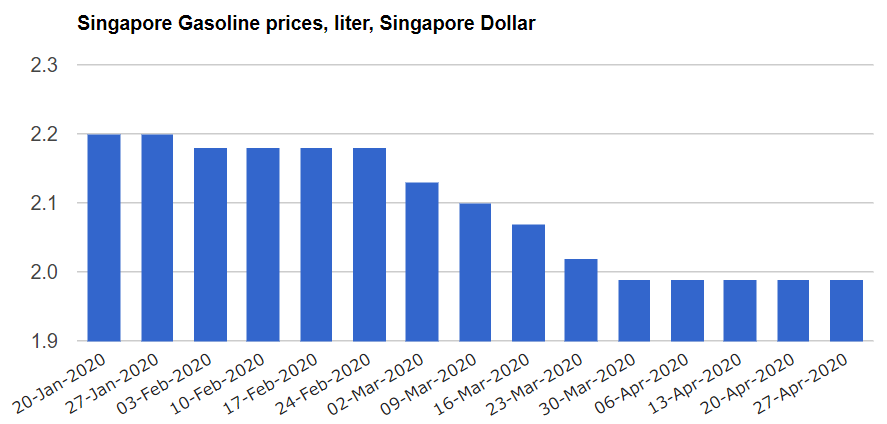

Superficially at least, the large movements in crude oil prices do not appear to translate to equivalent movements in average retail petrol prices in Singapore.

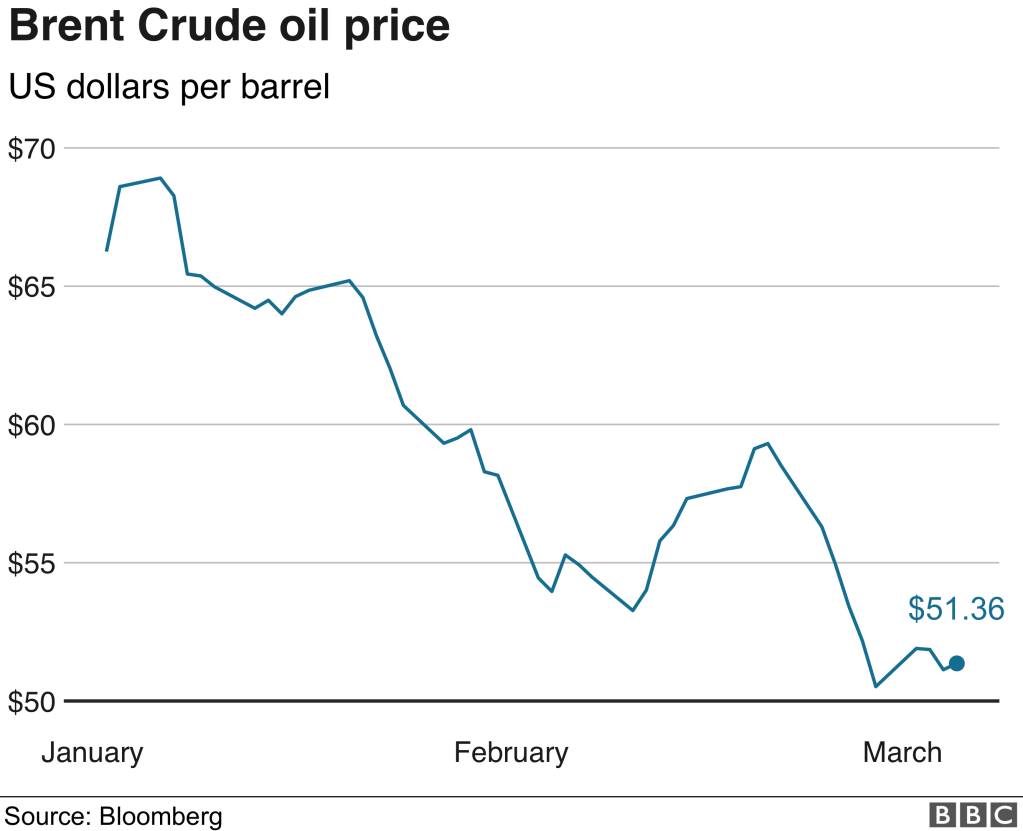

Between Jan and Mar 2020, Brent Crude oil price fell from ~US$65 (~S$92) to ~US$51 (~S$72) per barrel, while retail petrol price in Singapore fell from ~S$2.20 to ~$2 during the same period.

In absolute terms, the superficial pass-through rate observed from this quick and dirty data-set is only 1%, while in relative terms, it is roughly 40%. This suggests that the “true” pass-through rate across the oil industry is indeed lower than that of the narrower scope analysed by CCCS.

Does double marginalisation explain the price transmission discrepancy?

Unless I had:

- More data

- More time to find and analyse data

- Managed to retain ALL the advanced statistical techniques availed upon me courtesy of my Economics degree long ago.

The short answer would be that I can’t conclusively tell.

For those who have read the CCCS’ report, you would have known that a regression model was actually run to control for other potential explanatory factors – so it is not that simple.

But intuitively, the double marginalisation theory does make sense in explaining leakages in the price transmission.

In theory, vertical integration mitigates the double marginalisation effect.

But although the major petrol retailers in Singapore are vertically integrated (i.e. owns and runs the various supply chain stages), they often allow the various business units varying levels of autonomy in pricing and output decisions.

In addition, in practice, the negative impact of plunging crude oil prices to the upstream business units has been so large, that it is inconceivable for the parent organisation to pass on low crude oil prices in large extent to end-consumers.

It seems likely to be the case where the downstream business units (e.g. oil refiners and retailers) maintain higher prices to compensate for the losses across the parent organisation incurred especially in the crude oil market.

So will this be the opposite then for higher crude oil prices (i.e. higher crude oil prices are more easily passed on to end-consumers, fulfilling the Rockets and Feathers hypothesis)?

I would rather not commit to an answer without more rigorous analysis done. But Christopher Tan, from the Straits Times, had offered a somewhat convincing intuitive (non-rigorous) take to it, indicating that it may be expected that petrol prices go up more easily than the other way.

Spoiler alert – he had also pointed out some other factors at play, and as you may expect, that means more to come in this mini-series.

Overall, while the nature of the oil supply chain and the double marginalisation effect could certainly make sense the price transmission discrepancy observed, it is definitely only part of many other possible explanations.

If you had learnt something today…

Why not share it with others, or leave a comment below to interact with me?

Hit subscribe here to get my articles straight to your inbox hot and fresh!