Every now and then, as I conduct my lessons with my students, I would come across questionable reference materials.

It has reached a point where I was considering whether to compile such examples here, though I haven’t got around to it. Partly because I see little point to publicising them here for the sake of it, and partly because I am busy (and maybe lazy too).

Still, some statements were harder to ignore than others. Consider one encounter I had, where the justification for people in China having a “better standard of living” than those in USA was based on the observation that spending on internal security per capita in China was higher.

I do not dispute it, for the record. But I am aware that this line of reasoning possibly suffers from reverse causality: China’s higher spending on internal security may also be attributed to the need to tamp down instability at some locations.

In such case where the evidence can be mixed, I advise my students to be wary during exams: Either spell out these contradictions explicitly, or throw out the problematic justification altogether.

Key rule for essay writing in JC Econs 101: Do not leave openings for your target audience to tear into!

AirAsia is smaller than SIA (Singapore Airlines)

In another recent case, one school’s promo exam had a question that asked for justifications to the observation of small firms co-existing with large ones.

This is a typical question for “A” level H2 Economics, but one justification in the “model answer” stood out in particular, and it went something like this:

- Certain industries exhibit large scope for constant returns to scale (i.e. the total cost scales proportionately with production);

- Commercial air travel is an example of that (eyebrows slightly raised);

- For example, AirAsia, which is smaller, co-exists with Singapore Airlines (alarm bells ringing in my head now).

My curiosity got piqued.

That’s because I recalled news from a while back that AirAsia had made the single largest order for commercial aircraft in history. And I know from personal experience flying with AirAsia, that this is no piddling airline.

Is AirAsia really small? To reach a conclusion, we should be aware that “size” of airline can be measured in various ways. Let’s start with the obvious:

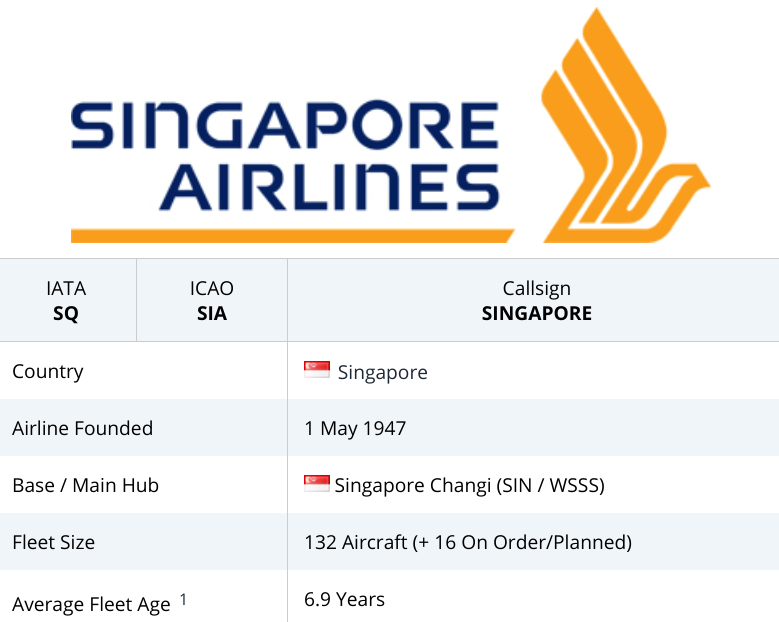

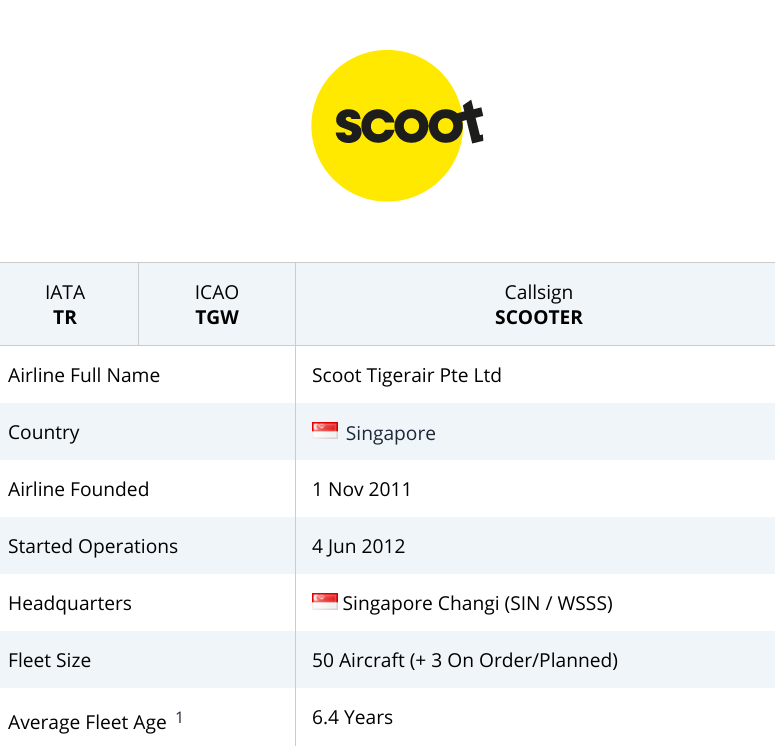

Air fleet size: AirAsia

Trust plane-spotters to keep up-to-date and well-organised data on planes around there world at the aptly-titled website Planespotters Net.

The compiled statistics show that AirAsia’s fleet (282 planes) is larger than SIA’s (132 planes) by a significant margin.

Astute observers would have noticed however, that the tally of 282 airplanes operated by AirAsia included those operated by various regional affiliates. These airlines were formed from joint ventures between AirAsia Group and regional partners and operate as franchises of the AirAsia Group.

Significant equity holdings and oversight under the AirAsia Group means that for “rightful” comparison, details taken for the group as a whole would be most relevant.

Of course SIA will not be outdone there, with 2 other wholly-owned airlines under the SIA Group: Silkair and Scoot.

So a better comparison with AirAsia Group would necessitate the inclusion of assets associated with Scoot and Silkair:

Including Scoot’s and Silkair’s air fleet will mean that the SIA Group’s air fleet is 208 strong. Still smaller than AirAsia Group’s!

Revenue: SIA

A superficial glance at the revenue figures for both groups:

- SIA (FY18/19: Apr 2018 – Mar 2019): S$ 16,323.2 M

- AirAsia (FY19: Jan 2019 – Dec 2019): RM 11,860 M

SIA Group is the clear winner here (you can do the necessary currency conversion if unconvinced).

Curiously, AirAsia Group has more aircraft, but earns less revenue. Having some context and more numbers on hand may help us understand why.

Some quick notes first though:

- Pre-COVID period was used in these comparisons – hence 2018/2019 rather than 2020.

- Profit was not used for comparison. That’s because profits are not good indicators for market transaction size. Consider how Grab is hardly an insignificant player, but have yet to turn any profit.

Staff count: AirAsia

The number of employees is often used as an alternative to understanding the size of a firm. Here, we observe that AirAsia is the larger of the two employers. Not clearly “small” here.

Passengers carried: AirAsia

- SIA (FY18/19: Apr 2018 – Mar 2019): 36,094,999

- AirAsia (FY19: Jan 2019 – Dec 2019): 51,559,070

AirAsia wins here – did it surprise you? You shouldn’t be really. Read on to see why.

Static fleet capacity: SIA

AirAsia is an LCC (Low-Cost Carrier), and it operates smaller jets compared to those operated by SIA proper (without Silkair and Scoot).

According to Wikipedia, which should be used as a rough reference only due to dynamic fleet configurations, the static passenger capacity (i.e. maximum number of passengers that can be flown at a given time, in current aircraft configurations) for the respective groups are as follows:

Size does matter! Even with more airplanes, the total static passenger capacity of AirAsia is significantly smaller than SIA’s owing to the size of individual aircraft operated.

Seats actually flown: AirAsia

At first glance, the evidence seemed contradictory: Despite having fewer seats, AirAsia carried more passengers than SIA.

Logic dictated therefore that AirAsia must have flown significantly more flights, increasing actual fleet capacity:

- SIA (FY18/19: Apr 2018 – Mar 2019): ~ 43,488,000 (estimated based on passengers carried / load factor)

- AirAsia (FY19: Jan 2019 – Dec 2019): 60,884,616

AirAsia had, in fact, flown so many more flights that the static capacity capacity deficit against SIA didn’t matter when it came to actual flying capacity!

As is the case for fixed assets, revenue generated scales with flight time, so both SIA and AirAsia would try to maximise flight time for each aircraft, with the usual standard being 12-14 hours per day.

Therefore, the short-haul nature of AirAsia flights naturally generates more seats flown than the parent SIA company (i.e. notwithstanding Scoot and Silkair, which form a much smaller part of SIA Group’s business), for similar flying hours.

Significantly, this brings us to the next (very important) point.

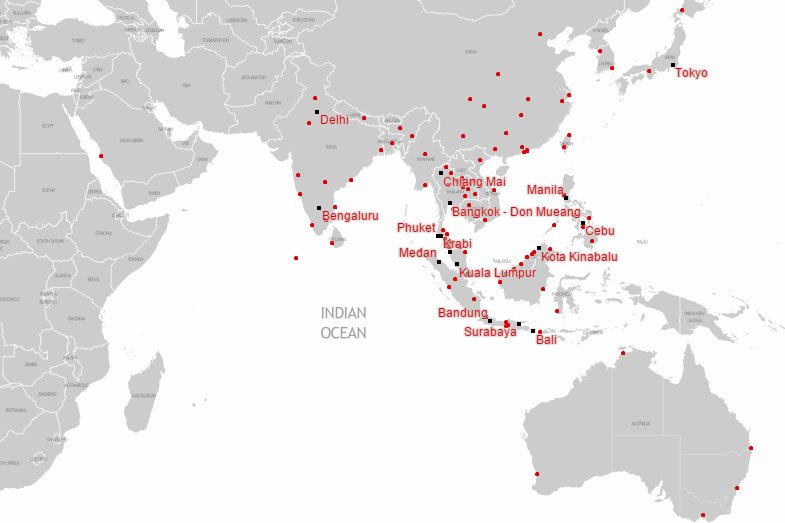

AirAsia and SIA do not compete directly.

Within the SIA Group, Scoot is probably the most similar to AirAsia in business model. But its relatively low contribution to revenue and profit to the group means that the SIA Group’s focus would be on the parent company, SIA proper.

Silkair, on the other hand, markets itself as the atas short-haul carrier, which is opposite to AirAsia’s “Now Everyone Can Fly” slogan.

The parent company of SIA Group, is a long-haul flight specialist that markets itself extensively to the well-heeled – who said that SIA plane tickets were cheap?

A couple of graphics below further illustrate how SIA Group and AirAsia Group do not compete directly in many cases:

It should be clear that SIA Group and AirAsia Group do not compete in the same air travel market space, which makes the school’s model answer’s choice of example in explaining large scope for constant returns to scale look feeble.

And I haven’t even gotten to how potentially problematic the assertion that airlines exhibit constant returns to scale can be. Just take a look at one such analysis here (not for faint-hearted).

I should add that the AirAsia vis–à–vis SIA comparison can be illustrative of how product differentiation and market segmentation can achieve co-existence between firms, small or large. But it wasn’t phrased as such in the model answer.

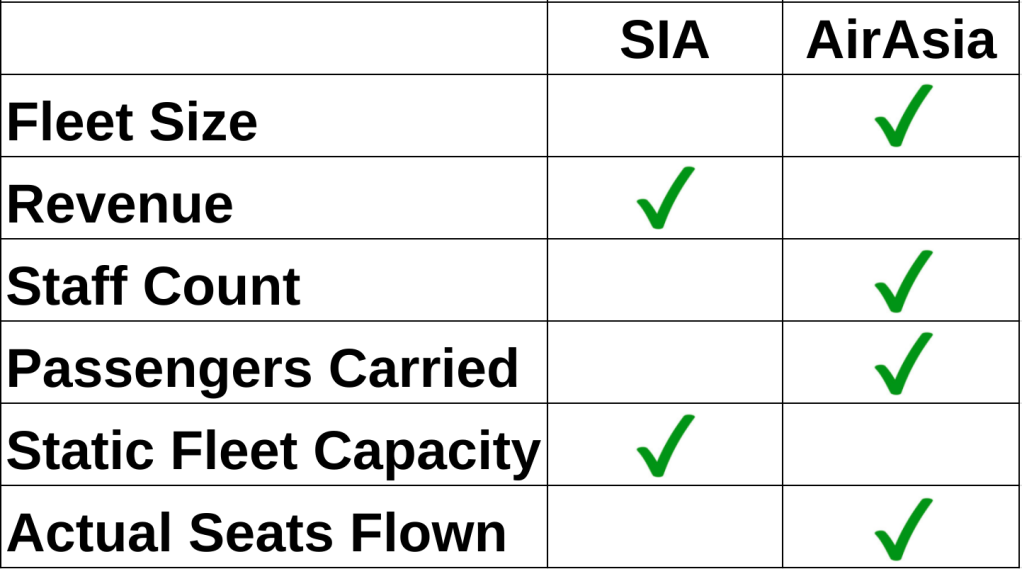

Based on the non-exhaustive list of metrics discussed earlier, in summary:

You tell me lah, like that how to conclude AirAsia is smaller??

Final words.

I had focused on passenger-carrying, but SIA carries mail and cargo too. In addition, SIA Engineering Company is yet another entity within the SIA Group, focusing on aircraft maintenance, repair, and overhaul (MRO).

I hadn’t included them in the analysis as passenger-carrying business is SIA’s focus and brings home the bulk of the spoils. But throw that into the mix and you have an even cloudier picture of how “big” SIA Group is.

AirAsia for the record, does neither such business.

As to how examples should be utilised in exams, I had written a response to one such query previously. For the sake of context, I should add that for applied examples (i.e. citing real-world examples), play safe and stick to one that is more familiar.

Avoid using “hairy” examples such as this one if possible!

Having read this I thought it was very informative. I appreciate you finding the time and effort to put this content together. I once again find myself spending a lot of time both reading and commenting. But so what, it was still worthwhile!

LikeLike

A big thank you for your article.Really looking forward to read more. Want more.

LikeLike