Last week, a student asked me for assistance on a question in a Case Study about the Purchasing Power Parity (PPP) Exchange Rate.

My first reaction was “oh this is a 2-mark question, that should be easy”.

Unfortunately it devolved into an extended head-scratching session because I hadn’t touched on that particular concept in ages.

Whilst not entirely excusable, this had to do with a lack of emphasis on this concept in the “A” level Economics exam (and consequently, by schools) for many years.

So, this became one of the rare “let me take it back first and answer you fully next session” moments for me as an Economics tutor, and I suspect that sharing my homework from that session will benefit you.

Don’t let such PPP exchange rate questions trip you up as and when they appear in the exam!

First, the Basics.

The premise behind Purchasing Power Parity, or PPP for short, is that: The financial impact of the purchase of a particular good or service across the different countries, should be equivalent to each same person, no matter his/her nationality.

Of course this doesn’t always occur in the real world (if at all), but there are good reasons why such a theory is taught anyway, as you will see later.

For now, some binding assumptions are needed:

- The absence of transport costs and other trade impediments;

- Perfect information; &

- Perfectly interchangeable goods and services.

In such a construct, equivalent goods and services offered across various countries will cost the same, from the perspective of each person regardless of the origin country. To see why, consider the following scenario, using the broadband Internet service as a specific example:

If the price of broadband service is cheaper in Singapore than in USA, then due to perfect information and product portability across countries, consumers in USA will increase their demand for broadband service from Singapore.

In that case, the rising demand for broadband service in Singapore, will result in the price of broadband increasing in Singapore. At equilibrium, purchasing power parity is indeed achieved, since the reverse holds true if the broadband service is more expensive rather.

Try it yourself!

Importantly, any utilisation of the PPP exchange rate carries the implicit assumption that it is the “correct” figure against which the observed exchange rates and prices are measured against.

This fact will be revisited repeatedly later.

Making PPP happen through Math.

The PPP exchange rate, which dictates the exchange rate at which the reference consumer will experience similar cost for the subject country’s good in his/her (reference) currency is simply:

PPP Exchange Rate = Preference / Psubject

Where PPP Exchange Rate here, represents the appropriate price (in the reference currency) of 1 unit of the subject currency that will fulfill PPP.

To see why, consider the case where both countries produce only 1 type of good, and therefore P represents the price of that good only.

In general, the price of the subject-produced good, in reference currency, is calculated with:

Price of Subject Good in Reference Currency = Exchange Rate * Psubject

Where Exchange Rate here, represents the prevailing price (in reference currency) of 1 unit of the subject’s currency.

By extension, therefore:

PPP Price of Subject Good in Reference Currency = PPP Exchange Rate * Psubject

Given that:

PPP Exchange Rate = Preference / Psubject

Then:

PPP Price of Subject Good in Reference Currency = Preference

Which is exactly what we need for PPP to hold true.

PPP can tell us how a good is priced.

With that, we can now delve into the Case Study that gave me some grief, to illustrate key implications of PPP Exchange Rates.

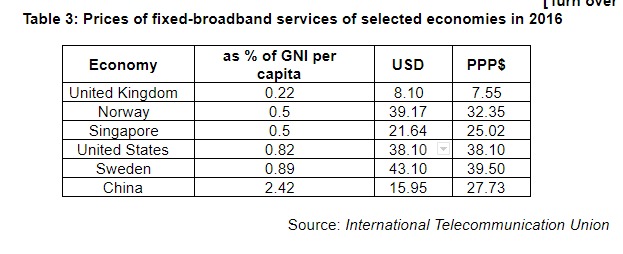

It is important to note here that this information matrix relates to the perspective of the USA. We know this to be true because the price of broadband in USA (in USD), is the same even after adjustment for PPP.

Focusing on the case of Singapore, the PPP price of broadband in Singapore is US$25.02, which is lower than the equivalent product in USA (US$38.10).

At this point, It shouldn’t take much of a logic leap to see that the price of broadband in Singapore might be “too low”, but let’s see if this is indeed true, step-by-step.

Consider how that figure would have been derived based on our earlier discussion:

Psg_bb_ppp = PPP * Psg_bb

Where:

PPP = Pus_gen / Psg_gen

Some additional explanation is in order here.

Because consumers do not usually consume goods and services in isolation, the PPP exchange rate is typically derived from the indexation of a representative basket of goods and services, hence the additional subscript “gen” which indicates “general”.

On that basis, it is reasonable to argue that the PPP term is an “authoritative” one in the above PPP-conversion formula (i.e. in isolation, it will always adjust for PPP correctly).

The only way therefore to explain the lower-than-expected PPP adjusted price of Singapore’s broadband, would be that the broadband in Singapore is “under-priced” relative to its cost of living.

PPP can tell us something about the exchange rate.

To see why, consider how the PPP-unadjusted price of Singapore’s broadband in USD (US$21.64), is lower than the associated PPP-adjusted price (US$25.02). We can state this as:

Psg_bb_usd < Psg_bb_ppp

Given that:

Psg_bb_ppp = PPP * Psg_bb

And:

Psg_bb_usd = EXR * Psg_bb

Where EXR is the price of 1 unit of SGD in USD.

The appropriate substitution will show that the lower PPP-unadjusted price of Singapore’s broadband in USD is explained by:

EXR < PPP

Again, applying the same logic that PPP must be the authoritative term, then the exchange rate of Singapore must be under-valued.

In summary, we can conclude that Singapore’s:

- Broadband price is under-priced, considering its general cost of living relative to USA;

- Exchange rate is under-valued, relative to the PPP-adjusted exchange rate.

Looking at the Norwegian case.

The virtues of tediously breaking down the essence of PPP in such fashion, despite not being required at “A” levels, can be seen when we consider a very common fallacy of assuming that a lower PPP-adjusted price must always be accompanied by a lower PPP-unadjusted price in reference currency.

We can see that this is not the case of Norway, which exhibits:

- Lower PPP-adjusted broadband price in USD (US$32.35) against the broadband price in USA (US$38.10); & yet

- Higher PPP-unadjusted broadband price in USD (US$39.17) against its PPP-adjusted broadband price (US$32.35).

But by simply applying what we have learnt earlier, we can easily conclude that Norway’s:

- Broadband price is under-priced, considering its general cost of living relative to USA;

- Exchange rate is over-valued, relative to the PPP-adjusted exchange rate.

PPP easy-peasy.

Demystifying the PPP exchange rate is a very tedious process that requires strong conceptual clarity.

Fortunately, such a thorough discourse is not required for the H1/H2 “A” level Economics exam.

The required knowledge for the “A” level Economics exam can be distilled as, for the given good or service:

- A lower PPP-adjusted price in a country, relative to the reference country’s, indicates under-pricing compared with its own cost of living; &

- A lower PPP-unadjusted price in a country in the reference currency, against the PPP-adjusted price, indicates under-valuation of its currency.

There’s definately a great deal to know about this issue. I really like all of the points you’ve made.

LikeLike