This is the 2nd installment to the “Wage-Price Spiral and Singapore” mini-series. Read the first installment here.

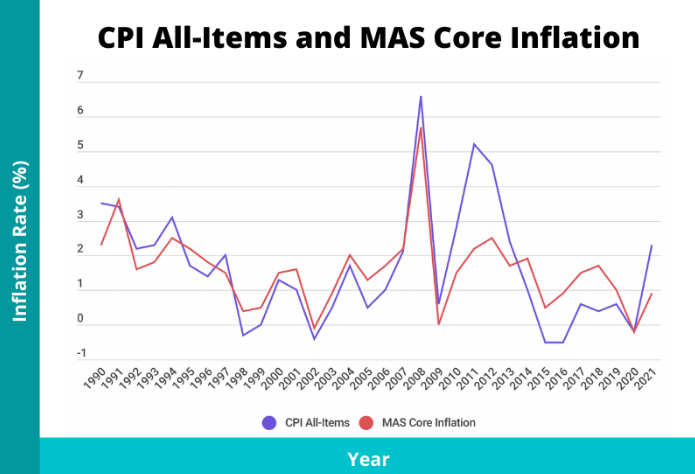

In my previous article, I argued that Singapore has legitimate reasons to be wary of inflationary pressures. Especially because the presence of the Wage-Price Spiral can inflame the situation beyond the initial onset of higher-than-norm inflation.

Naturally this means that the second installment will deal with macroeconomic policies in dealing with inflation over both the short and long-term.

Exchange Rate.

MAS has always been proud to point out that unique amongst economies globally, Singapore almost exclusively uses the SGD’s exchange rate as its heavy-weight monetary policy. For the uninitiated, the detailed explanation to its use can be found here.

In fact between posting this article and the previous one, MAS made a mini-news wave when it announced that it was slightly increasing the rate of SGD appreciation without waiting to do so in its next half-yearly window.

Conventional economic wisdom dictates that the pursuit of lower inflation rates will hurt economics growth (and employment levels). We can intuit however, that:

- Economic growth can be compensated for by other means; and

- Imported inflation can threaten economic growth, in addition to direct impacts to consumers.

The former can indeed be achieved by supply-side policies that we hear frequently about in Economics, and in The Straits Times. To quickly name an example.

As for the latter, although an appreciating SGD makes exports more expensive and therefore dampens net exports growth, because Singapore’s producers tend to import raw materials, this has a beneficial effect of reducing the impact of inflation to costs of production.

The trade-off between either approach (less vs more expensive SGD), can be summarised as such:

| Approach 1: Cheaper SGD | Approach 2: More Expensive SGD |

|---|---|

| Higher cost of production | Lower cost of production |

| Exports become more price competitive | Exports become less price competitive |

Approach 2 is favoured by Singapore for reasons mentioned above. It also has the benefit of reducing immediate cost pressures to firms due to imported inflation, thereby stabilising employment levels.

In addition, Approach 2 is consistent with Singapore’s continual effort to climb the product value chains, which improves opportunities for differentiation (reduce sales volatility due to price fluctuations) and also fatter profit margins.

Not forgetting too, a major consideration for Approach 2 is also its immediate positive effect to consumers by lowering imported inflation.

Importing Labour.

Cost pressures feed into price pressures. So to reduce the strength of the wage-cost feedback loop, opportunities in keeping costs lower need to be actively sought.

Needless to say, that logic features strongly in Singapore’s penchant for foreign labour inputs. The picture is arguably more complicated, with other considerations such as “Singaporeans not loving dirty work” etc. But there is no denying that keeping labour costs low is a significant factor.

Doing so will at least tie labour costs in affected sectors, more closely to regional wage rates which tend to be lower.

Quick disclaimer: The claims above were based on heuristics and piecing together available information and prior research done by other esteemed parties. Unsurprisingly, publicly-available data from MOM on the above, specifically, are hard to come by – so my assertions should be taken with some pinch of salt.

Aside from the direct easing on labour cost pressures by importing foreign labour, from the perspective of the Wage-Cost Spiral, there are at least 2 other “positive” effects on general prices.

The first is that foreign labour, by its nature, is transient, unlike resident labour. At least anecdotally, a reduction to the stake in the Singapore story should correspondingly reduce the possibility of wage pressures coming from living costs alone from these workers.

The second effect is only too familiar for many Singaporeans – that lower wage costs afforded by foreign labour, also translates to a reduction in ability for resident labourers to negotiate for higher salaries in response to higher living costs.

A few days ago, it was announced at the FY2022 Budget Statement that firms can qualify to hiring foreign workers only if all local workers are paid at least $1,400.

In fact, opposing cries of that move being too much (from employers), and too little (from local employees), converge on the reality that local wages have been depressed all these years through generous foreign labour inflows.

Improving labour productivity.

From the perspective of better macroeconomic performance, higher wages as a response to consistent inflationary pressure are justified only with improvements to labour productivity.

Does this sound familiar to Singaporeans?

To see this line of Economic reasoning, we can turn to some diagrams depicting a firm’s profit levels based on the respective TR (Total Revenue) and TC (Total Cost) for the given labour input levels. For ease of depiction, the former is assumed to be influenced by diminishing marginal returns, and the latter is assumed to be linear (i.e. cost increases linearly with amount of labour input). More on these theories can be found in my notes here.

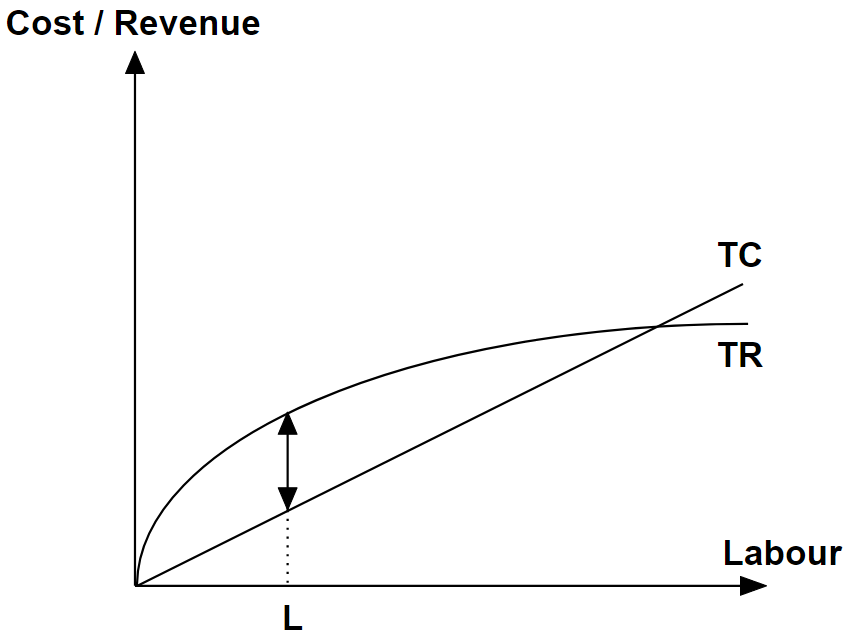

Our starting point would be the identification of the appropriate labour input to maximise the firm’s profit:

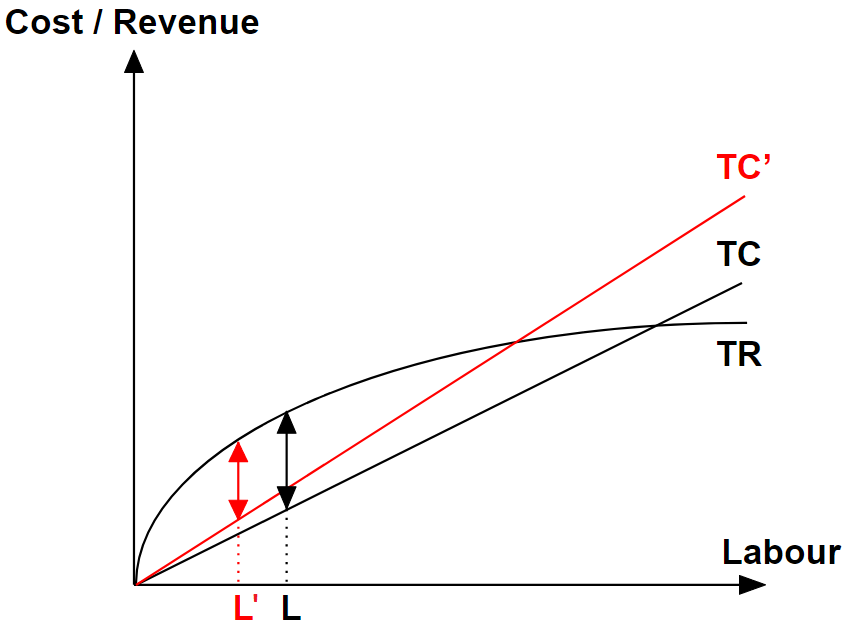

With an increase with wage, resulting in an escalation to TC, we can observe that the firm’s desired level of labour falls from L to L’ (increased unemployment), and the profit of the firm falls (smaller TR – TC in red)

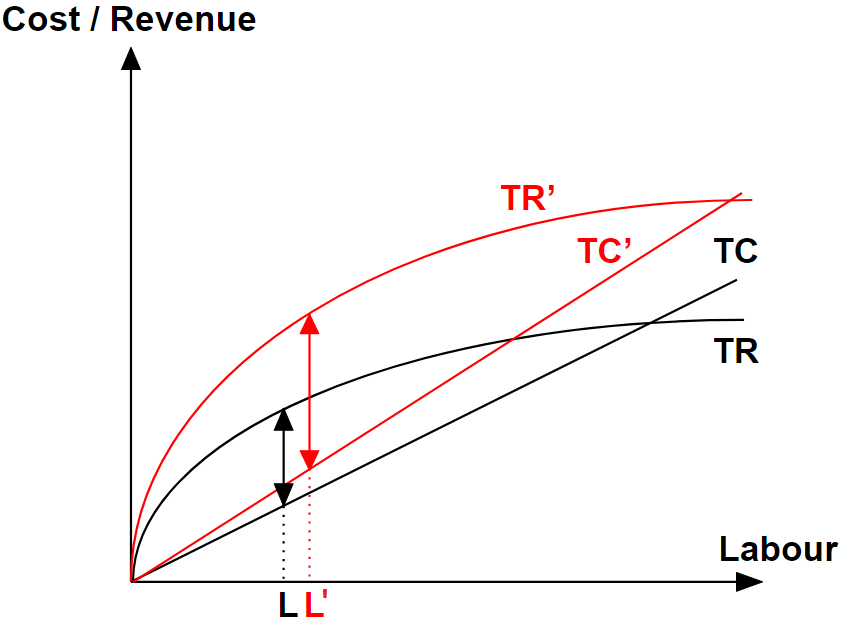

But all’s not lost! If the productivity of labour improves, and TR increases for each level of labour, it is possible for the demand for labour to increase instead (if the productivity grows faster than the wage rate)!

In a perfectly circular economy, improving labour productivity in tandem with inflationary pressures enables wage to keep pace with cost increase, and also reduce inflationary pressures by increasing output.

As argued in my previous article, this is not so the case with Singapore, since most of our consumption needs are imported. Instead, the greater fear is that should TC rise faster than TR, profit levels will drop and weaken the case for business to set up shop (and spend) in Singapore (and employ locals).

This of course, doesn’t directly describe the Wage-Cost Spiral, although this doesn’t make the stated problem better.

Rather, in the absence of pursuing all-out growth, improving labour productivity seems to be more a response to the typical Singaporean’s expectation of wage increment to cover almost-consistent positive inflation year-on-year.

There are 2 broad ways to improve labour productivity. One is to the increase the ratio of capital-to-labour (i.e. increase capital creation rate), and the other, to improve the synergy between capital and labour (the infamous cheaper, better, faster).

Singaporeans should be all-too-familiar with the Singapore government’s enthusiastic embrace of capital, and constant exhortations to “upskill”. So I shall leave it at that without further elaboration.

Final word.

Quite frankly, the solutions as laid out above, shouldn’t appear as sudden thunder-claps to you, if you are Singaporean, given the various more-or-less consistent messages from the government.

However, exploring the same set of solutions from the perspective of specific problems can often glean various interesting insights to the Singaporean economic reality.

What do you think? Comments and sharing of your personal insights or research into the matter are appreciated as always below.

What’s up, after reading this awesome piece of writing iam too delighted to share my experience here with friends.

LikeLike