With the worries of COVID-19’s impact to economies going on unabated, naturally much attention is focused on recovery policies such as the “classic” expansionary demand-management policies.

As always, the uninitiated can refer to my notes available online, if you need more information on what they are, but basically, they are a class of economic policies that stimulate short-term economic activity.

As most, if not all economics disciples know already, central to the efficacy of demand-management policies, lies the multiplier effect. But what then?

The multiplier effect is not a cure-all.

Many Economics disciples appear to retain this concept decently well. So when confronted with sagging economies, it is not uncommon to hear commentaries speaking about how consumer must spend, triggering the multiplier effect for the exogenous stimulus.

In fact it has become quite a set of go-to “hallowed” words uttered by the common folks and even (I suppose) atas observers like The Smart Investor, that I wondered if all these chatter actually debased certain pitfalls we should be aware of.

My “last straw” came when a friend sought to convince me of his optimism, by rehashing this whole thing to me – ala “A” level style!

I should be clear that there is nothing particularly wrong – but neither were they particularly enlightening and my key grouse is on how simplistic these espousals of the Multiplier Effect can be.

In fact it frightens me because it is easy to mistake simple-mindedness for easy-to-digest insights. So bear with me while I point some of these out.

The multiplying mirage?

In a nutshell, GDP measures economic activity and if you felt that it is a concept somewhat abstracted from your life, you might be on to something.

Part of this reason has to do with how GDP is calculated – it takes into consideration the monetary expenditure on goods and services in the country. A key idea behind the use of GDP as a measure of material living standards lie with supposed value-creation in demanding and consuming goods and services.

But the composition of such spending matters.

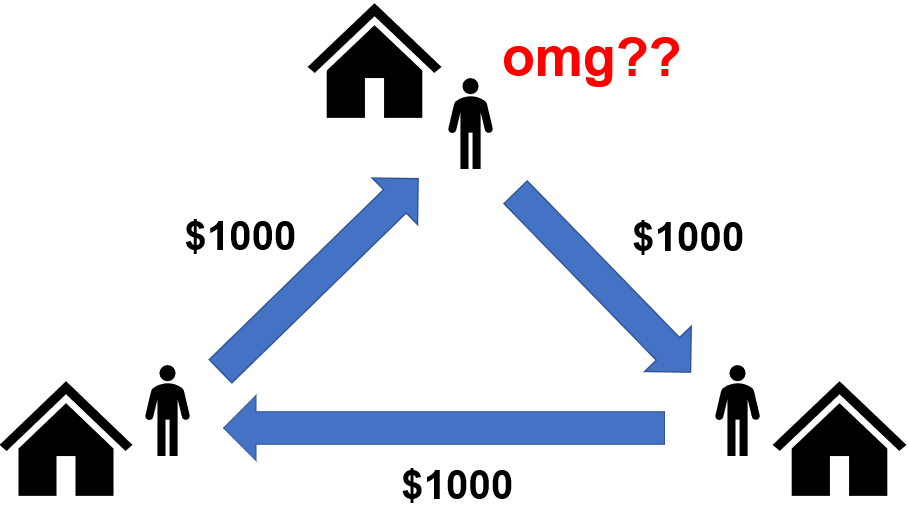

Take for example, an extreme scenario where someone pays for his house rental with his entire income, and the landlord pays for his personal house rental with that same amount, and the next recipient does the same…excepts he pays to the first guy. Cue a house rental loop.

Of course since nobody spends solely on house rentals, this scenario doesn’t play out quite like that in the real world. Consider the implications however, of how there is arguably no “real” value-creation to this economy since these houses were built.

Rentals for fixed assets like houses are counted towards GDP, the premise being they are services rendered to the consumer. The problem is that our living standards are tied strongly to the overall production of actual goods and services, rather than economic activity per se, that often includes rental transactions.

Am I against rentals and leases? No – a mix of leasing and owning/producing in the economy helps in reducing transaction barriers, which promotes resource efficiencies in the long-run. Think of how the “sharing economy” has been a boon for many, entrepreneurs and consumers alike.

However, we should be clear that the mix of asset/capital ownership does matter in the recovery trajectory of the economy. An economy with less broad-based ownership (i.e. more leasing/renting) may have a greater risk of uneven, or even “un-real” recovery with economic stimulus.

Economic stimulus often ends up with the rich.

Less broad-based ownership is of course tied to the increasing polarisation of wealth distribution. A side effect to this has been the hollowing out of the middle class, with the rich getting richer, the poor getting poorer, and those still in the middle getting “squeezed“.

This has consequence on the outcomes of economic stimulus too. To see why, let’s take for example the case of one-time payouts to individuals, like in the case of USA’s CARES Act (textbook helicopter-drop economic stimulus).

In the case of individuals who rent, some of these stimulus will inevitably end up with landlords, who presumably by virtue of capital ownership, are already wealthy. I probably over-generalise a little, but those who are asset-rich but cash-poor still do not get my sympathy.

And what about (poorer) landlords who are paying off mortgages even as they rent their places out? Well, the stimulus nestled in the rent then goes to the lender, which in most cases would be the banks.

Supposedly, the role of banks would mean that the money they received would be utilised in more loans to others for productive economic activity, resulting in a virtuous cycle of value creation.

In case that sounds familiar, I was still describing the textbook multiplier effect. Cue “small” problem ahead.

The problem is that lenders (banks in this case), do not readily lend to any Tom, Dick or Harry. There are various reasons to that, which were wonderfully covered by Banerjee’s piece, who by the way, received the Nobel Prize in Economics in 2019 for his research on poverty.

If it was too much trouble for you to read, basically the banks tend to lend to their own flock (the rich). This attempt at summarising won’t get me the Nobel Prize in Summarising, but that discourse is not my focus here.

You could be reading this and thinking that if you spent only on “real” goods and services, then the stimulus would not find its way to the already wealthy. Unfortunately the reality is that, especially with polarisation of wealth and asset distribution, it is almost guaranteed that the stimulus will still find its way to the wealthy at some point. Not least because:

- Spending on the “poorer” auntie/uncle’s offerings has a disproportionately higher chance of financing payments to landlords/creditors (asset ownership is less likely); and

- Money cycling through the economy gets there simply by virtue of doing just that – like how a cockroach flying in random still somehow hits you. Eek!

The trickle-down myth.

Actually, having the stimulus reach the rich as part of the multiplier’s process isn’t bad at all. After all it is the wealthy who generates jobs for those who were less fortunate in the race for wealth.

If that sounded familiar, it is because trickle-down economics have long been held as the key justification for all manners of pro-rich policies whose purpose is to…ok, never mind – the labelling is self-evident.

We know better now after a few decades of dismantling regulations that have supposedly hindered the rich and powerful. Look no further than the 2007 Subprime Mortgage Crisis.

I should be clear that I am not, in particular, villifying Singapore’s penchant for inviting wealthy foreign individuals and corporations to set up shop here. It would be good for us to recognise the good such a policy has done for us and why it should not be criticised for the sake of it.

My point, rather, is that economic stimulus, once in the realms of the wealthy, tends to circulate there without returning in kind to other segments to the economy.

Just look at what Mr. Dyson is best known for in Singapore in recent times (other than the abandonment of the electric car project, which was one of the supposed reasons for arriving at Singapore in the first place):

The rich are certainly free to do as they will with their wealth. But you can be sure for most, spending on less atas goods and services (which is a key way for a broad-based multiplier to work) is not a priority.

As for the rejoinder that they would create jobs and benefit their host economies? If so, we wouldn’t be discussing about inequality in the first place!

Perhaps it is inevitable.

Given how money tends to gravitate towards swelling nodes of its kind, perhaps it is inevitable that the multiplier effect, after making its rounds in the lower echelons of society (if at all), ends up benefiting the rich.

Does that mean that economic stimulus is pointless? Of course not – rightly targeted economic stimulus is always welcome for many who are suffering from the depressive effects of COVID-19.

From my perspective, if I, as a run-of-the-mill observer, could point out some of these pitfalls about unbridled optimism in economic stimulus, perhaps it pays to be more attentive (but not overly-cynical!) to unintended consequences of economic stimulus.

Awsome post and right to the point. I am not sure if this isactually the best place to ask but do you guys have any thoughts on whereto get some professional writers? Thx 🙂

LikeLike