Can u help me summarise the diff btw floating, fixed and managed exchange rate mkt?

Here’s a brief summary as below. For more details, please refer to my notes.

Floating Exchange Rate:

- The exchange rate is determined by supply and demand in the foreign exchange market.

- Currencies can fluctuate freely based on economic factors, interest rates, and speculation.

- Can be more volatile, which can create uncertainty for businesses involved in international trade.

- Does not allow the country to utilise exchange rate as a monetary policy tool.

- Can act as a self-correcting mechanism for the balance of trade.

Fixed Exchange Rate:

- The government (central bank) sets and maintains the exchange rate at a fixed level.

- The central bank intervenes in the foreign exchange market by buying or selling its own currency to maintain the fixed rate.

- Provides stability and predictability for businesses engaged in international trade.

- Can be used by the country as a monetary policy tool.

- Unable to self-correct the balance of trade and may allow surplus or deficits to persist.

Managed Exchange Rate (Dirty Float):

- A hybrid system that combines elements of both floating and fixed exchange rates.

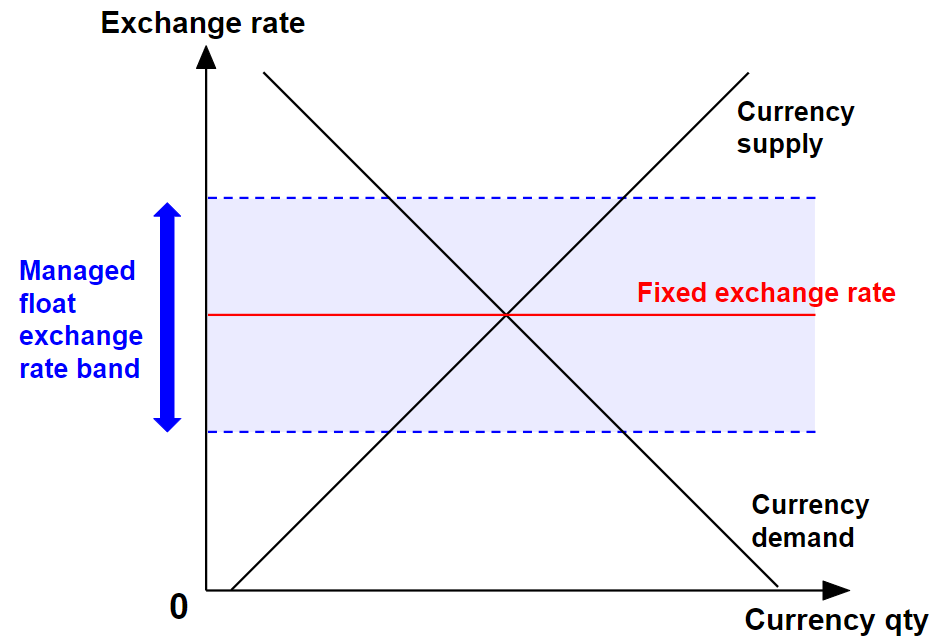

- The exchange rate is allowed to fluctuate within a band or target zone set by the central bank.

- The central bank intervenes in the market to prevent the exchange rate from moving outside the target zone.

- Offers some degree of flexibility for monetary policy while maintaining a degree of exchange rate stability.

Summary of characteristics:

| Exchange Rate Market | Determination | Flexibility |

|---|---|---|

| Floating | Market forces of supply and demand | Highly flexible |

| Fixed | Government intervention | Inflexible (red line in graph below) |

| Managed | Combination of market forces and government intervention | Somewhat flexible (within blue band in graph below) |