Unlike their A-level counterparts, students studying Economics in the IB curriculum are required to elaborate further on how the price mechanism eventually results in the new market-clearing quantity.

In particular, there have been feedback on schools insisting that their students make explicit reference to the signaling and incentivisation aspects of the price mechanism, and this has been an increasingly common source of confusion from students.

This article aims to clear the confusion up with practical explanations that are repeatable for the IB exam and Internal Assessment papers.

How a price mechanism process is triggered.

At market equilibrium, the price and output always occurs where demand intersects supply in the demand-supply diagram.

When either demand or supply (or both simultaneously) changes, a decentralised and automatic process is triggered, that allows for the appropriate movement of price and quantity back to the market equilibrium.

This is referred to as the price mechanism (a.k.a the invisible hand). A process that informs the appropriate allocation of resources for production at the market-clearing quantity level.

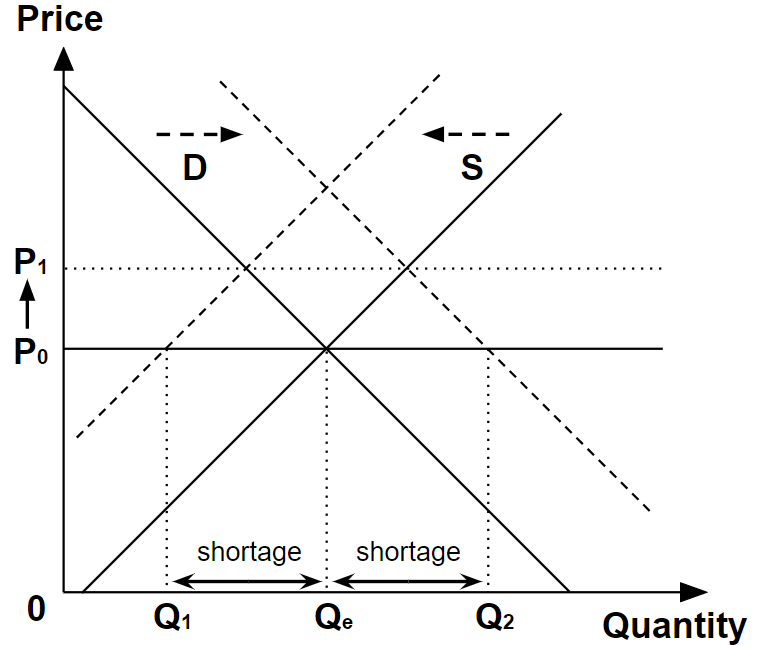

We can generate an upward movement on price by causing a shortage through either increasing demand, or decreasing supply:

Conversely, we can generate a downward movement on price by causing a surplus through either decreasing demand, or increasing supply:

The determination of whether a shortage or surplus arises as an immediate effect of a change to supply and/or demand allows us then to proceed onto the process of the price mechanism.

The price mechanism in the case of a shortage.

When there is a shortage, suppliers will observe a reduction to their inventories (stocks of their stored products).

This causes an upward pressure on price as suppliers need to increase price to reduce the sale of the good and justify an increase in output to maintain their inventories at a stable level.

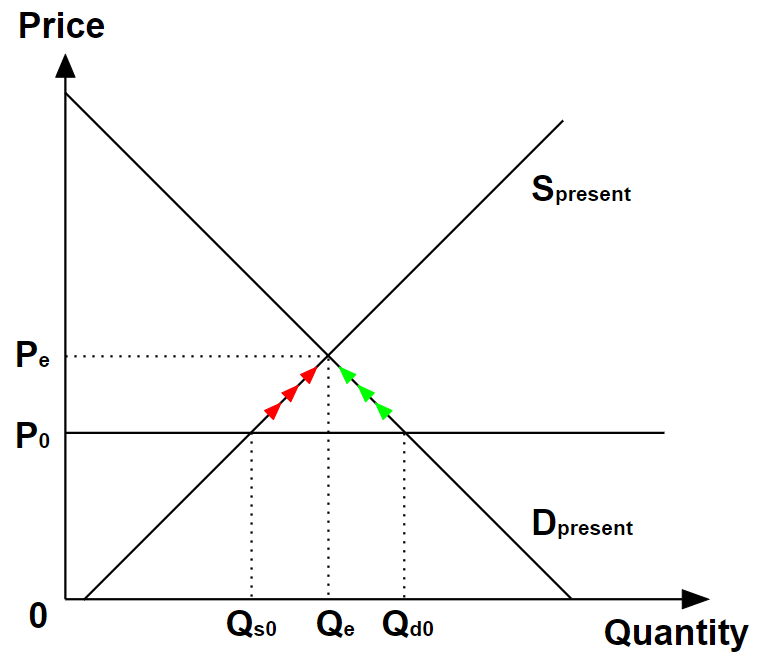

Producers will increase their quantity supplied (red arrows) and consumers will decrease their quantity demanded (green arrows) until the market clears again at Qe:

A rising price signals to producers:

That there is a shortage in the market and there is unmet sales that can be fulfilled by increasing output.

A rising price incentivises producers:

To increase output as rising prices increase the per-unit profitability of the good, allowing the higher per-unit production cost caused by higher output to be offset, increasing total profits.

A simpler explanation, but which involves prior understanding of firms’ revenue and cost considerations, is that the marginal revenue increases, which increases the profit-maximising output level.

A rising price signals to consumers:

That there is a shortage in the market and there is a need to increase their willingess and ability to pay, to ensure they can secured the desired quantity. This desired quantity necessarily falls because the higher price reduces the consumer’s purchasing power.

A rising price incentivises consumers:

To find substitutes that are cheaper and therefore reduce their consumption of the good or service.

The price mechanism in the case of a surplus.

On the other hand, when there is a surplus, suppliers will observe an increase to their inventories.

This causes a downward pressure on price as suppliers need to reduce price to increase the sale of the good. In addition, cutting output to eliminate the surplus reduces the per-unit cost of production and allows suppliers to sell at a lower price.

Producers will reduce their quantity supplied (green arrows) and consumers will increase their quantity demanded (red arrows) until the market clears again at Qe:

A falling price signals to producers:

That there is a surplus in the market and output has to be reduced to prevent further increases to inventories.

A falling price incentivises producers:

To reduce output as lower prices decrease the per-unit profitability of the good, and the lower per-unit production cost due to lower output offsets the reduction in profit caused by lower prices.

Again, the simpler explanation (in my opinion) is that the marginal revenue decreases, which decreases the profit-maximising output level.

A falling price signals to consumers:

That there is a surplus in the market and it is possible to secure a higher consumption level with the lower price.

A rising price incentivises consumers:

To substitute away from alternatives as it is now relatively cheaper and more attractive to consume more of the good or service.

And it’s a wrap!

This has to be one of the fastest articles that I had written (no more than 1-2 hours), which underscores what appears to be, the ease of explaining the price mechanism using the concepts of signaling and incentivisation.

However, it should be mentioned that the above explanation took a while to unwrap and digest from mulitple textbooks and sources, which suggests that studying Economics can drive students up the wall at times.

This set of explanations have been utilised by my students to great effect at their IB exams and their IA papers, so I hope they would be useful to you as well, having made it to the end of this article.