As we study Economics as a subject, a common theme often emerges – that a well-meaning government is expected to intervene through economic policies for the better good of society.

Such policies include taxation, subsidies, quotas, price ceiling/floor etc. These are tools that are designed to guide the market to the desired state through their specific channels.

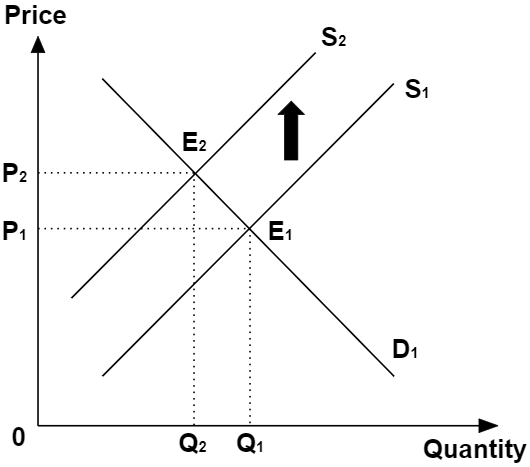

As an example, an Indirect Tax adds to the cost of production per unit produced, resulting in an upward shift to the supply curve. This will cause a reduction in quantity supplied, ceteris paribus.

In many cases, “A” level students are expected to explain the limitations to economic policies during the exam. A common tactic adopted by students is to memorise the relevant points, in addition to the hundred other key points that they will cram into their heads before heading to the exam.

As you can imagine, unless you have some kind of photographic memory, trying to memorise everything for the sake of it can lead to problems during exams such as stress, confusion and mind-blocks, to name a few.

Do not attempt to memorise before understanding the underlying concepts!

Memorising content is often an inefficient way of studying for your Economics exam, chiefly because you are compartmentalising knowledge in your brain as you memorise in silos.

The more efficient way to learning Economics (and for many other subjects), is to understand the underlying concepts as a starting point. This builds up your knowledge by drawing links to the concepts you had learnt before, and drawing further links to new knowledge along the way.

Going back to the topic of evaluating government intervention, and using the example of Indirect Taxation, it is important to note that:

Theoretical Framework and the relevant Parameters are the key inputs for an Economic Policy

The key question that the government is trying to answer here is:

How much tax should be imposed on the suppliers?

Looking at our Indirect Tax graph above, we see that the answer to the above question depends on the amount of shift to the Supply Curve that you will require to achieve your desired outcome.

Do you see that fundamentally, you are using the Demand-Supply framework (embodied by the graph) to answer?

The assumptions of the Demand-Supply framework form the Conceptual Issues in formulating the Indirect Tax.

For “A” level students, it suffices to know that in reality, prices often cannot be explained solely by demand and supply, because key assumptions such as perfect knowledge and arms-length transactions do not always hold true.

For a more thorough explanation, this article does a really good job in explaining the limitations of the Demand-Supply model.

Gathering data to derive the demand and supply curves is easier said than done.

Ever encountered pesky people knocking on your door, or along the streets, asking you to help fill up survey forms? Did you double-back to avoid them? Or did you answer the questions blindly with no care for the world?

Spare a thought for them next time! Gathering accurate data can be really difficult, and it isn’t just about surveys. In many cases, the required data is often inferred from indirect sources.

For example, it is impossible to derive the demand and supply curves using infinite data points. Instead, a reasonable amount of data points is used and statistical methods such as “best-fit” and “extrapolation” are employed to fill the gaps.

Key takeaway – Conceptual and Measurement Issues reduce the effectiveness of government interventions.

And there you have it – easy evaluation of government interventions during the exam!

Even though I used the example of Indirect Taxation here to illustrate the key issues in formulating economic policies by the government, these salient points can be used whenever you are required to evaluate government interventions.

This exam tip has been used to great effect by my students over the years and has been one of my favourite weapons in tackling the evaluation of government intervention.

If you liked reading this blog post, please do share it with your classmates! Also, feel free to comment below!

For more information about my services as a JC Economics tutor, do visit my website here.