In 1993, the World Bank released a report named The East Asian Miracle. At the time of its release, it was the most comprehensive report that attempted to shade light on how and why the East Asian region experienced astonishing growth from 1960 up till that time.

It has been nearly 25 years since then, but even now, the report is still highly influential and regularly cited as a reference for other studies or publications. It was a highly insightful piece that greatly aided our understanding of how Hong Kong, Indonesia, Japan, Malaysia, Singapore, South Korea, Taiwan, and Thailand (collectively known as the HPAEs – High Performance Asian Economies) grew.

Background to the World Bank report

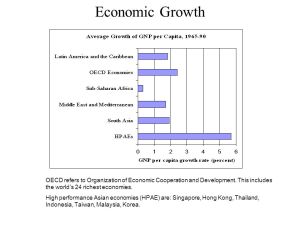

Between 1965 and 1999, the HPAEs grew more than 5% on average, which was 3 times that of Latin American and South Asian countries, and 5 times that of the Sub-Saharan Africa nations.

In particular, Singapore had grown its economy by 8.5% per annum which was 3 times as fast as the United States during the same period. The macroeconomic indicators have also been exceptional in these countries:

- Real income per capita increased more than 4 times.

- Non-material indicators were outstanding as well. Life expectancy increased from 56 to 71 years and literacy rates improved to beyond 90%.

Naturally, there was strong interest in understanding how the HPAEs could be a potential role model for other countries, which formed the key motivation behind the 1993 World Bank report on the East Asian Miracle.

How the HPAEs achieved high growth.

The report noted that the crucial factors could be explained or categorized based on 2 prevailing schools of thoughts: the Neoclassical and the Revisionist.

The Neoclassical school focused on markets as the superior method of resource allocation, with an emphasis on “getting the prices right”. The Revisionist school on the other hand tended to focus on the argument that the markets often failed, and government intervention was a key factor to ensuring the success of the economy.

The report’s greatest contribution was how it chose not to side with either schools of thoughts, and instead focused on using the data gathered, to show merit to both sides of the story. The list of key factors can be summarized as follows:

- Physical and human capital accumulation, with high levels of savings.

- Strong and clear legal framework, with good business environment, enabling confidence in conducting business in these economies.

- Fundamentally sound macroeconomic policies, with good fiscal performance, inflation management and export-centric strategies.

- Market-friendly approach, which allowed optimal and efficient resource allocation in the markets and strong business sentiments.

- Strong government intervention where necessary, either through the use of regulations, incentives, or “Contests” where the winner got favourable treatment and even direct investments.

- Shared Growth principle was utilised as a motivational national-level story that described how the development of a strong economy would help everybody, encouraging citizens to work harder and be entrepreneurial.

- Rapid technological catch-up, including eager adoption of foreign technology to enable quick levelling up and cultivation of the necessary skilled-labour.

The list of factors revealed that both the Neoclassical and Revisionist schools of thoughts have clear merits in their arguments to what would grow the economy well.

For example, the combination of market-friendly policies and the setting up of good business-friendly environments was a tactic well-supported by the Neoclassical theories. At the same time, the use of strong government interventions in the form of market guidance or even direct interference at times, was strongly supported by the Revisionist theories.

Contributions made by the World Bank report.

A major contribution of the report was therefore the showing that both schools of thoughts could co-exist in the same economy. At that time, the prevailing view had been that liberalizing the markets was the best way to grow and develop an economy. A well-known and influential example of this was the “Washington Consensus”, which attempted to prescribe a set of neo-liberal policies for a developing country to grow.

But where the report truly excelled was how it showed that both schools of thoughts could not be easily divorced from one another clearly. For example, creating a business-friendly environment appeared to be a nod to Neoclassical theories on the surface, but could realistically only be achieved with highly focused government efforts, be it in infrastructure or the legal framework, which was a key point in the Revisionist theory.

Similarly, using “Contests” to determine the best companies to support, looked like a Revisionist-based concept on the surface, given that the exercise is a government-sanctioned one. But the arena of the contests was a neo-liberal market-based setting where the objective was to let the “free market” choose the winner.

Other examples of such seeming contradictions included how the HPAEs appeared to utilise a strategy that could be described as “getting the prices slightly wrong”, where a mix of getting the market fundamentals right, but with some “meddling” from the government was utilised.

A major conclusion of the World Bank report was to show that a one-size-fit-all strategy was unlikely to work, not just in terms of general development strategies, but even on a country-basis. The report did not aim to be the best guide for countries seeking development strategies – instead it was a compilation of everything the writers knew up to that point about the HPAEs and their key characteristics that enhanced their developments.

Hindsight is 20/20 however.

Although the report was excellent in compiling much relevant information about the HPAEs, it was obviously only up to the point it was published, in 1993. Since then, with the benefit of hindsight, it would appear that many of the observations made may have been somewhat too optimistic.

For example, strong government support towards cultivating “missing markets” was then seen to be a highly effective solution in creating new future drivers of growth in the report. But today, many of these developed industries now suffer from massive overcapacity and inefficiencies which are now slowing the HPAEs ironically.

Similarly, it has been noted that certain characteristics of the HPAE, such as “good governance”, tended to appear as good during the time of strong economic gains. But these same factors were later cited to be “bad” when it transpired that the HPAE’s had loopholes in the legal framework, shoddy banking regulation and poor corporate transparency.

Probably the best example was the demise of Hanjin Shipping, which was one of the top ten shipping companies globally. It was a model example of the virtues of being part of a Korean Chaebol, which could draw on its extensive network to pool resources and power its growth. Unfortunately, it would appear that the corporate governance of Chaebols was also arguably questionable on hindsight, and the result was the filing of bankruptcy of Hanjin Shipping in 2016.

Some other issues the World Bank report ignored.

The report focused on internal characteristics of the HPAEs and did not appear to give much consideration to external factors. The growth period of the HPAEs coincided with the peak of the Cold War between the USA and the Soviet Union. The location of the HPAEs was such that they had strategic significance in the USA’s efforts in “containing” the then communist states of China and Soviet Union.

The direct effect of the Cold War on the HPAE was the stationing of USA’s military assets in these countries, which contributed to the stimulation of their economies as they provided stores and supplies for the USA’s armies.

The indirect effect of the Cold War was USA’s continued interest and support of the region, and the cultivation of “model states”. For example, South Korea was offered US$60 billion in foreign aid from the USA between 1946 and 1978. In contrast, the entire African continent was offered only the same amount during that same period of time.

Finally, the World Bank report noted that the experience of the HPAE may not be easily replicable in other parts of the world, but had no reply to what could be done for these countries. This limited its contribution because it could not advise for countries with characteristics that differed significantly from the HPAEs.

In some cases, the country may not be able to grow as rapidly because of various limiting factors such as war or even natural disasters. Such economic prescription is not suitable as the main focus should be on short-term recovery, rather than long-term development of the economy.

In other cases, the starting-point of an economy can differ extremely significantly from that of the HPAEs. For example, half of the African economies have significant semi-nomadic populations. It is difficult to see how we could utilise the experience of the HPAEs and apply it to these African economies, because these require the assumption that the populations are sedentary in nature.

The World Bank report was a great masterpiece nonetheless.

In its defense, the report represented the best of our knowledge at that time, and did not benefit from the hindsight we have today. Such reports are very important to us and contribute greatly to our understanding of how and why the HPAEs had developed exceptionally in the span of a generation.

In addition to giving us new knowledge about the HPAEs’ experience, the report gave us a great starting point to take our latest knowledge, and build upon information we already know. As we live in a highly dynamic world, it is difficult to have universal strategies that would be able to advise us forever. In that sense, it would be impossible to have a perfect report that stays entirely relevant forever.

Lend your support!

I hope that you have enjoyed reading this article of mine. I am giving my time to sharing my knowledge and every bit of support means a lot to me! Do drop me a comment or share this article on social media with your friends.

To find out more about my services as a JC Economics tutor, visit my website here.