Last month, we wrote an article about Why Anti-Trust Laws Are So Difficult to Enforce. We hadn’t anticipated that shortly after, Grab and Uber would attempt to create for us, a real case study by officially announcing the merger of their South-east Asian operations in Mar 2018.

Not surprisingly, this piece of news has became the major talking point of late. The story could have faded away into distant memory like most news, but for the fact that the Competition Commission of Singapore (CCS) has waded into the picture, first by announcing that it was considering an intervention to the merger, before confirming the set of interim measures to be imposed a couple of weeks later.

As it’s not often that the theory gets explained and a real case study pops up almost immediately, we will take this opportunity to share our point of view on this turn of events.

The latest intervention by CCS is unprecedented.

In our previous article, we discussed about how Anti-Trust regulators often have to strike a right balance between allowing the free market to function unfettered, and stepping in when consumers are being harmed by “unfair” lack of competition.

In all cases thus far, CCS has investigated supposed offenses on an ex-post basis. In fact, in its thirteen years of existence since 2005, CCS had never issued an Interim Measures Direction (IMD) before.

Many coffee-shop pundits therefore expressed surprise in the wake of CCS’ imposing the IMD. Most had previously considered CCS to be “all talk, no action”, and very much akin to the tortoise racing against the hare (i.e. mostly playing catch-up).

But CCS’ response shouldn’t be surprising.

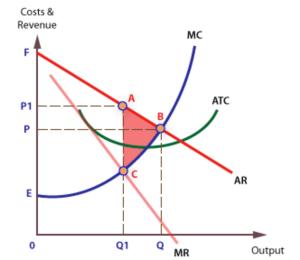

Those of us who are familiar with Economics theories would of course be aware of the Economics reasoning behind CCS’ concerns over the merger between Grab and Uber, as shown in the graph below.

A monopoly formed by the merger between the two market leaders would lead to a loss in societal welfare equivalent to the area ABC in the graph.

And it isn’t just the theory that should have predicted this “heavy-handed” reaction – CCS had made no secret of its close monitoring of the Private Hire market.

When Uber announced its deal with ComfortDelgro in Dec 2017 with the latter acquiring a majority stake in Uber Singapore’s car rental arm, CCS followed up with an investigation into whether the deal was an infringement of Anti-Trust regulations.

While it is true that the actions taken by CCS then was considered mild and well-within the usual rhetoric, ComfortDelgro acquiring a 51% stake in Lion City Rental was also a mild move in comparison to the deal between Uber and Grab which would have seen:

- Grab acquiring Uber’s entire Southeast Asian operation (including regional assets, data, key personnel, etc). And worse,

- In exchange for Uber having a huge 27.5% stake in Grab.

If this was not an outright attempt by both parties to “make peace”, and take the “easy way” out to solidify their stranglehold on the Private Hire market, then we don’t really know what else is.

Clearly, CCS must have agreed with our assessment, because it moved at an unusually fast pace to halt the deal in its tracks, which…

Took Grab by surprise.

It transpired that Grab/Uber had not formally notified CCS about their intentions on the merger.

It would be safe to presume that Grab is aware of the possibility in notifying CCS voluntarily on their next course of action. Therefore the logical conclusion to Grab’s action would be that it had figured:

- Doing a “blitzkrieg” merger would enable the whole event to be wrapped up before CCS could react sufficiently.

- CCS would not intervene directly in the matter, sticking to its usual slower process we have observed thus far.

If this was indeed the case, then Grab’s assumptions were very wrong indeed. In fact we believe, on hindsight, that what Grab did was the equivalent of waving a red cape to the bull (CCS).

Some hints to how rattled Grab has been can be seen from their rather feeble attempt to mitigate negative sentiments towards the merger by claiming that potential entry into the Private Hire market by Ryde and GoJek was proof of low barriers to entry.

If this sounded “wrong” to you even if it made superficial sense, then you were right. And that’s because Grab had flagrantly chosen to omit the fact that Network Economics, rather than traditional capital-intensive requirements pose formidable barriers to entry here.

It didn’t further help Grab that regional competition watchdogs have followed Singapore’s lead and announced their respective measures against the merger. It seemed to us that Grab has sorely underestimated the extent to which it could get away with a “quick and dirty” merger.

Not considering Private Hire vehicles to be “public service vehicles” turned out to be fortuitous.

When Uber (and later, Grab) first entered the Singapore market in 2013, there was a dilemma with the regulators as to whether these new entrants should be regarded as similar to the public taxis.

The categorisation of their stated product was important, because if Private Hire vehicles were considered to be “public service vehicles”, they would have to be subject to a similar set of regulations, which included among others, conformance to the Quality of Service and Taxi Availability standards.

The competitiveness of Grab and Uber lay in:

- Their use of technology to achieve matching between passengers and vehicles,

- Not needing to drive a minimum mileage unlike traditional taxis.

- The use of “surge” pricing which improved matching the demand and supply for vehicles (and also convert more consumer surplus to producer surplus). The idea is not new, but not implemented in Singapore because LTA had until then frowned on such a pricing model for “public services”.

It was no wonder then that Uber and Grab (and other similar companies) argued strenuously against being classified in the same categories as the taxis in Singapore. They eventually “won” their case, much to the concern of other stakeholders such as the National Taxi Association, which was worried about an uneven playing field.

It would seem now that recognising Private Hire companies to be different from taxi companies, was not only logical (because the operating model is different), but actually worked against any attempt towards consolidation in that industry, and should therefore be considered a masterful stroke.

In a statement released on 30 May 2018, CCS noted that:

CCS has reasonable grounds for suspecting that section 54 of the Competition Act (Cap. 50B) (the “Act”) has been infringed by the Transaction due to substantial lessening of competition in relation to the chauffeured personal point-to-point transport passenger and booking services (“CPPT Services”) market in Singapore.

The outcome would probably have been very different if Uber and Grab were considered to be similar to the taxi companies in Singapore, as that market would have been substantially “more competitive”.

On hindsight, what seemed like a favourable ruling by LTA for Grab, to segregate Private Hire companies (Grab/Uber) from Public Services ones (traditional taxis) then, has essentially cornered Grab now.

As they often say, you can’t have your cake and eat it too!

So what next?

Like many of you, we are paying close attention to the developments of this saga. At this point, our final thoughts to this article are that:

- Grab will carry on trying its hand in entering more markets in an attempt to become “too big to exit”. This strategy is in recognition that,

- CCS has a wide range of measures it can choose to impose on Grab. The current set of interventions are already unusually heavy-handed (e.g. forcing Grab to maintain its current pricing). But it may get more brutal, including forcing the merger to unravel.

Lend your support!

So what are your thoughts?

I hope that you have enjoyed reading this article of mine. I am giving my time to sharing my knowledge and every bit of support means a lot to me! Do drop me a comment or share this article on social media with your friends.

To find out more about my services as a JC Economics tutor, visit my website here.