It was announced earlier this month that the US Federal Reserves would be cutting interest rates by half a percentage point and the target interest rate range is now between 1 – 1.25%, as an “emergency” response to the COVID-19 coronavirus economic threat.

This is a textbook response to contractionary economic pressures: Reduce interest rates to stimulate domestic consumption and investment by reducing borrowing costs, and decreasing the opportunity cost of spending.

Some commentaries however did not take the Fed’s announcement too kindly, and have argued instead that the move would not be of particular help. You can see examples of these statements here and here.

What can we make of the Fed’s rate cut then? Is it really useless? Or is there more than meets the eye?

The COVID-19 economic rampage.

There is no mistaking that the COVID-19 is ravaging the global economy.

On the demand-side, tourism and travel are badly affected, especially since China, as the biggest single outbound market, is in lock-down mode in an attempt to contain the spread of the disease. Also, individual countries taking steps to prevent, or at least reduce, the chance of the infectious entering from abroad and causing community spread.

To give some perspective, by 2018, tourism and travel (including business-related ones) was already accounting globally for >10% of GDP and 1 in 10 jobs. In fact, the sector was growing so fast that it accounted for 1 in 5 new jobs created.

Aside from the direct economic impact borne by the tourism and travel sector, the lower output and income is also further transmitted across the economies via the multiplier effect, resulting in further contractionary pressures to the global economy.

Countries have also found increasing need to implement containment measures to slow the spread of the disease, even domestically, further reducing domestic consumption.

And then there are the effects on the economic supply to contend with.

Apart from containment measures disrupting workers’ operations and the supply chains, there have also been efforts to divert resources away from the production of various consumption goods, towards the production of medical supplies needed in the fight against COVID-19.

So, this is very much a perfect economic storm, with strong contractionary effects felt on both the global demand and supply. The effects to global output will surely be felt very strongly.

Considering we are only into the 2nd to 3rd month of the outbreak and the economic bad news is already very bad and worsening, with nobody being able to predict the end to it, markets are obviously very jittery and the Fed is compelled to slash interest rates in response.

Interest rate cuts are no panacea against COVID-19.

After saying this much bad news about the economic impact of COVID-19, it should be abundantly clear that this is a huge disruption to the global economy for a variety of highly diverse and serious reasons.

The Fed’s monetary policy may be a potent tool under most circumstances. But trying to stimulate the economy ravaged by so many factors covered above using interest rate cuts, is somewhat like trying to treat a patient with multiple organ failure with paracetamol.

I said “somewhat”, because the mortality rate for such patients can be as high as 100%. I am hopeful that we will be able to put the COVID-19 outbreak behind us eventually, even though we will have to contend with major disruptions to the global economy.

But you should get my point that interest rate cuts are certainly no panacea against the COVID-19 economic threat. Even more so when interest rate is surely not high on the list of concerns for businesses already neck-high in existential problems. A fall in aggregate supply too, would be beyond the ability of interest rates to support output growth.

Being in a liquidity trap won’t help matters either.

There are reasons to believe that the USA is in a liquidity trap – a situation where interest rates have fallen so low that they are no longer effective in affecting the aggregate demand, rendering the monetary policy useless.

In fact, real interest rates are already negative, with the current inflation rate at 2.5% (based on rolling 12-month periods), which exceeds the prevailing nominal interest rate of under 2%. Real interest rates are the real deal, rather than nominal interest rates, because the returns on loans should take into account the loss in actual value of the loans through inflation.

It is therefore doubtful that cuts to already negative real interest rates will have significant effects on investment decisions, rendering the monetary policy pretty much moot.

Still considering that the EU Zone and Japan have already cut interest rates past zero, the USA is not quite in the worst of states yet. But most observers believe the USA is just about one recession away from that psychological “dark side”.

So why did the Fed bother then?

There were commentators who questioned the wisdom of the Fed’s latest rate cut, for the reasons I had stated above. But I would point out that it is highly unlikely that the Federal Reserve is staffed with people who are unaware of the consequences of their actions.

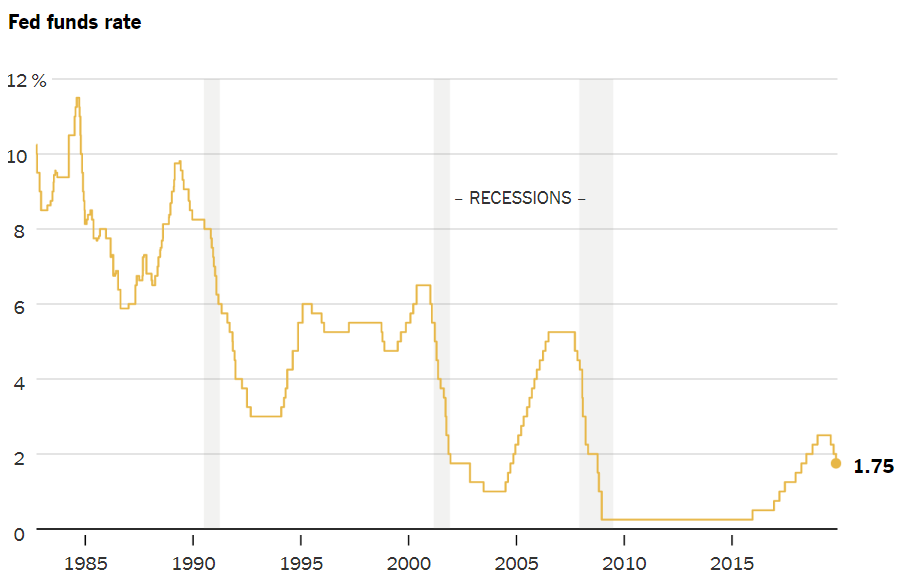

In the prior 5 years, the Fed had been trying to incrementally raise interest rates, ostensibly to build some interest rate buffer to shore up the monetary policy’s effectiveness when required.

But the incremental increases in interest rate in the years post-2015 didn’t manage to inch it past 2.5% before Donald Trump imposed a trade war with China, necessitating multiple interest rate cuts in 2019 to head off the negative impacts of the bashing match that followed.

While the wisdom of Trump can be questioned, it is also worth noting his obsession with low interest rates, which means he would not see himself as a contributory factor to the current Fed’s quandary. And of course the fact he doesn’t see eye-to-eye with the Fed (or whatever he considers to be the “Deep State“) certainly complements his continued conflicts with the Fed.

Given the relative difficulty of raising interest rates (which can only be done “safely” during good years without curtailing growth too much), it stands to reason that the Fed will not take the decision to cut interest rates lightly, suggesting compelling reasons to do so.

The Fed might just be “doing its part”.

Various detractors of the interest rate cut have pointed out that developing a holistic approach, emphasising on containment and making sure that the healthcare sector is prepared to deal with COVID-19, is a “more appropriate” unified response by the US government.

But they are really missing the fact that the Federal Reserve (and many Central Banks globally), is intentionally “independent“, at least officially because of the need to separate political noise from economic decision-making.

While there is no denying the arguably slow response of the USA in responding to the virus entering its borders, the Fed’s mandate is to maintain maximum employment, and stable prices, through the use of monetary policy.

In addition to the threat of COVID-19 to the US economy, there is also the backdrop of recessionary warnings earlier in 2019, when the Treasury yield curve inverted multiple times as a result of investors flocking to safe havens.

Given these circumstances, the Fed’s rate cut is therefore not surprising at all. But the magnitude of the cut, at a massive half percentage point, the largest single cut since the 2008 financial crisis, certainly took many by surprise.

Of course, if your aim is to give a positive jolt to investors, your best bet would be to spring a surprise. And work it did. But only for a while, before the Treasury yields carried on their merry way downwards, slumping to record lows, strongly suggesting the presence of a liquidity trap.

Who knows?

So is the Fed’s rate cut justified? Probably.

Has it been effective? Not really.

The economic threat by the COVID-19 will be extremely difficult to tackle. And the Fed’s monetary policy response being greatly weakened by market pessimism over the last few months will certainly not help matters.

So it appears the Fed’s hands are tied, but it doesn’t mean that it would just stand by without a rate cut, especially since there were already recessionary pressures prior to the sudden appearance of COVID-19 in Dec 2019.

And that’s what I have to say for now.

This was super intresting to read. Thanks for creating it. You made a long-term reader and I’ll be back to read more. Thank you for sharing.

LikeLike