Ever so often, I would be writing a piece for my readers, and a recent event or trend would catch my attention, drawing me to open yet another draft to publish ahead of the queue.

This piece was one of them.

My trigger was the recent trend of share prices in distressed companies rallying, to the confusion of many “learned” observers.

The first one that caught my eye was the share price rallying of car rental MNC, Hertz, following announcement of its Chapter 11 bankruptcy on 23 May 2020.

Hertz’s share price cratered immediately following the announcement to ~US$0.50. This is expected share price behaviour as traders off-load what is now a very risky asset. But a little more than a week later, the share price started to rally, peaking at ~US$5.50 – a roughly 10-fold increase in share price!

At that time, I thought: Sure, this would be a one-off event my friends would be sharing with me via news bites for the next few days.

But it didn’t stop there. To cite a couple more cases in the last few days:

GNC filed Chapter 11 bankruptcy on the night of 23 June 2020, and its share price rallied nearly 100% a day later.

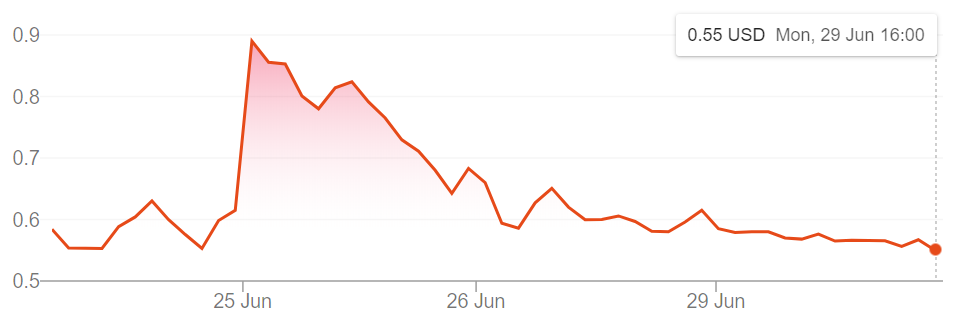

Wirecard announced it was “missing” US$2.1B in cash on 18 June 2020, causing its share price to collapse (expected result). What was harder to understand, but which fit into recent observations, was how share price rallied >500% after Wirecard declared itself insolvent on 25 June 2020.

Superficially, these observations are weird. Shares of companies that are no longer able to pay up should not be going up by so much. Especially considering the fact that the dividends will be zero and if liquidated, shareholders are last in the queue to receive compensation, if any left at all.

So what to make of that?

The Efficient Market Hypothesis

Our starting point is a theory in Economics that had gained popularity from the 1960s.

Aptly known as the “Efficient Market Hypothesis”, its key assertion is that an asset’s price fully reflects the prevailing information about its true value. If you would like to know more about it in detail, this video by Chegg does a very good job at summarising it:

By “efficiency” in this case, Economists mean the price is “right”, which is the same as saying that the market price reflects the actual value of the asset accurately.

There are of course many extensions to this theory to account for empirical observations that don’t appear to add up.

The most obvious to this being: If you can’t beat the market over the long run, why even start? (Spoiler alert: Because having perfect information is not a “friction-less” process and there will be agents who are better positioned as a result).

In theory therefore, with these extensions in tow, the share prices should reflect the “correct” value of the shares – which imply that investors had information that is reflected in the value of the stock.

If this sounds too good to be true…

You can bet that you are right.

The three companies quoted as examples here are distinct in their own rights, and their circumstances are by no means shared.

Yet we have observed that their share prices followed a similar pattern – the share prices:

- Cratered at bad news (Expected)

- Rallied a while later (Really weird sh*t)

- Fizzled slowly (Adjusting back to “normal” for a share that had “lost its way”)

If the market was truly efficient, we should expect differing price trajectories due to the the differing circumstances behind each distress.

Yet, although the key common trigger to these observations is “bad news”,the market had similar responses to all 3 cases. This is arguably a sign of systemic market inefficiency.

The logical next line of thought to that would therefore be: What if the market turns out to be inefficient after all?

Who started the irrationality?

In the absence of adding more parameters to our Homo Economicus traders, the simplest explanation behind “mis-pricing” in the market would be irrationality (i.e. the agent’s behaviour doesn’t conform to the “standard rational behaviour”).

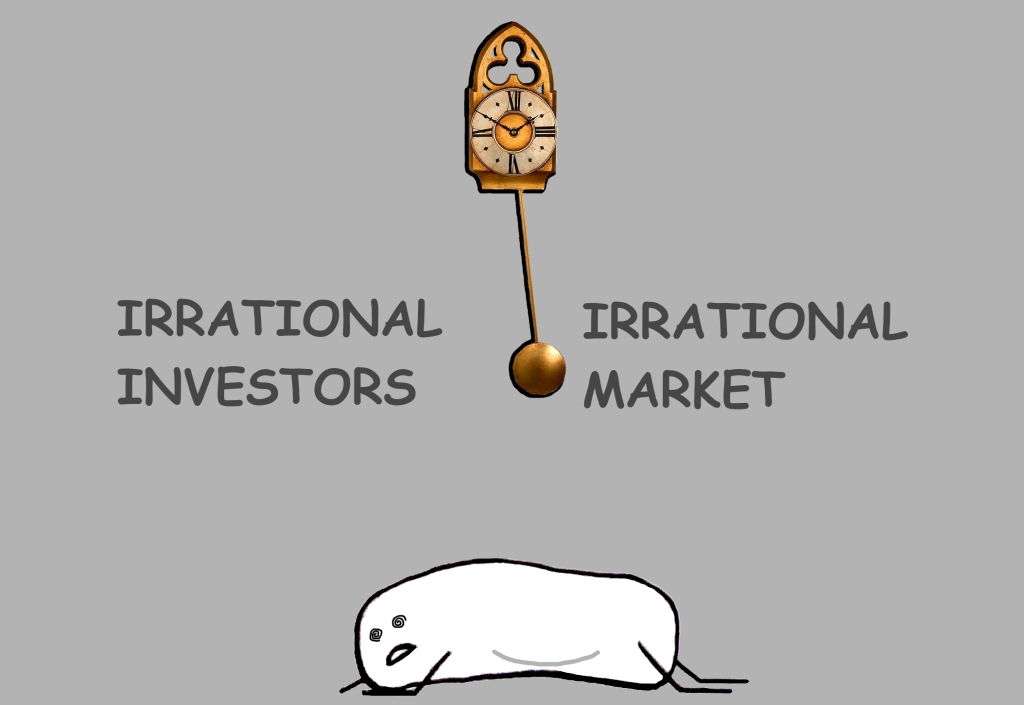

If we dig deeper, it becomes plausible that we are confronting a chicken-egg question, i.e. which came first:

- The irrational investor; or

- The irrational market

The irrationality loop.

Let’s say the starting point is an efficient market (i.e. the prices are “correct”).

If we assume that the rise in share price following news of distress is due to the market pricing positive expectations (e.g. strong fundamentals may allow good revival of the company), then investors will take the cue and invest accordingly.

There is a catch though. Based on what we know by now, investors tend to suffer from a couple of bias that make them decide irrationally:

- FOMO (Fear of Missing Out)

- Recency Bias

FOMO causes investors to rush in/out of the share market.

Recency bias on the other hand, is a psychological tendency to place more weight on the recent price movements in deciding whether or not to purchase the share.

Both bias will tend to exaggerate the “correct” price movements in the share market, causing the supposedly efficient market to turn inefficient.

But considering that markets constitute people, and if these bias were inherent to us, won’t that imply anyway that markets are inefficient to begin with? After all, prices are driven by the collective buy/sell actions (a.k.a demand-supply).

So then the assertion that irrational market cause irrational investors, may well be as correct as saying irrational investors cause irrational market. This is a classic feedback loop that doesn’t discriminate between the possible starting-points.

Perhaps a Not-so Efficient Market is inevitable after all.

The rise of retail investors.

In recent times, the barriers to entering the stock market have come down significantly, enabling ordinary folks who “do not play big” to enter the market.

If you wish to start trading the “traditional” way, you will have to go through some hoops to sign up for a trading account. To give you an idea how:

Enter new-age free-trading apps like Robinhood, which allows us to quickly set-up a trading account, and more importantly, do away with brokerage fees.

A key stereotypical characteristic of retail investors (i.e. ordinary folks like you and me), is that they tend not to be “pro”, unlike institutional investors.

Are they therefore necessarily “less rational” than institutional investors? I wouldn’t make a stand here, but there have been accusations that apps like Robinhood have unleashed a legion of inexperienced traders driving strange price trends.

For example, the rallying of distressed shares can perhaps be explained by trading driven by the oft-cited “buy-low-sell-high” mantra.

This is “long-buy” in its simplest form, and hopefully if you buy enough shares when they are distressed, even if some will ultimately fail, there will be others that stage a good comeback and you can then sell for gains.

Taken further into extreme, many retail investors could very well be buying and selling in short order, realising gains on the short-term rallying of the distressed shares, until someone is left holding onto shares whose prices decline again as the market refuses to value them any higher (as observed in Hertz, GNC, Wirecard).

Rational behaviour? It might seem so from the individual retail investor’s perspective, but the sum of all parts may well not be.

Economic stimulus, but not the real one.

Perhaps more disturbing is the combination of lower barriers to entry to the stock market, and fiscal stimulus due to the current COVID-19 crisis.

In May 2020, the US government approved an emergency fiscal stimulus, which included putting up to $1,200 into the pockets of individuals from the lower and middle income strata.

Now, “A” level students should be able to identify this as an expansionary fiscal stimulus to boost output and reduce unemployment by stimulating (real) consumption.

But guess where some of the money went to? You got it – speculation in the stock market via Robinhood.

There are observers who have compared the current state of the financial market to a casino – implying that retail investors had only gambling in mind, when they used the Robinhood app to invest the fiscal stimulus supposedly meant for their necessities (or at least real consumption to boost the economy).

The truth is probably more pluralistic than that, and points to further considerations (due to COVID-19) that the retail investor had probably taken into account when using the fiscal stimulus on shares speculation:

- Historic low interest rates lowering the opportunity cost of speculation in shares.

- Higher levels of saving due to a reduction in consumption.

- Fewer alternative investment opportunities due to a reduction in commerce.

Key Takeaways

So using my considerably simple analysis, it can be shown through the COVID-19 experience that:

- The Efficient Market Hypothesis doesn’t readily explain much of the share pricing phenomena observed, mostly because the market and its constituents are not conclusively rational. This isn’t the first, nor will it be the last such example.

- The unprecedented economic upheaval coupled with disruptive technologies democratising the shares market playing field further complicates price movements, but can explain the “weird” rallying of distressed share prices.

So do you think such price movement trends will become mainstay for the foreseeable future as more people become woke to retail investing, and the economic havoc wrought by COVID-19 will be felt for years to come?

Share your thoughts with me by leaving your comments below!

This was an excellent piece of content. I really liked it. I’ll be back to see more. Thank you .

LikeLike