A while ago, I had the privilege of reading an acclaimed book titled Adults In The Room: My Battle With Europe’s Deep Establishment, written by then Greek finance minister, Yanis Varoufakis.

Significantly, Varoufakis was the Greek finance minister in 2015, which if some of us can recall was right smack in a particularly tumultuous time for a number of European economies, with Greece being the poster child for the wrong reasons.

Reading this book got me got more than I bargained for. Not only were the details politically lurid (cue the title of the book), but Varoufakis was an unusually good story-teller for an academic. I was shocked by what I read, although if I had put more thought into it, it really shouldn’t have been surprising.

Of course, getting information about an event from a sole source makes for biased knowledge. But some of his assertions were hard to ignore, and one of them at least, warranted a mention here.

Misguided Austerity?

I am old enough to remember the 1997 Asian Financial Crisis. It was a major depressive event for us in Singapore and many of our neighbours, and its effects ran their course for a very long time for some.

It is now widely acknowledged that the MF bailout conditions, which was focused on “restoring confidence” to the recipient economies, made the situation much worse, at least in the initial critical period.

To cite just one IMF bailout case, Indonesia’s GDP contracted 13% in 1997. Bearing in mind that those were the pre-COVID “Roaring 90s” days, such numbers stood out ghastly.

As the thinking went at that time, the economic crisis was sparked off by unsustainable foreign debt, therefore budget prudence was the way to go to restore confidence to panicky investors. Today’s Economics disciples would be horrified to know that the IMF’s conditions for badly needed loans included raising interest rates, reducing fiscal spending and even increasing taxes.

Years later, there would be grudging acknowledgement from the IMF that the loan conditions actually throttled these economies at the trough of the crisis. But if only the matter ended there.

History repeats itself.

Some further applications of “tough love” since, were less straightforward. Argentina for example, had been in economic doldrums for 2 decades already.

When I was at Buenos Aires 2 years ago, I turned the TV in my hotel room on, only to watch a fiery exchange (in Spanish) in the Argentinian Congress, though not to the extent of the occasionally violent ones in East Asia.

I later found out that the debate was about further cuts to the government budget, for which as in most similar cases, support was seldom unanimous. More so in Argentina, which was suffering from a major political schism between the Peronists and other factions.

Sadly these fiery budget debates in Argentina were nothing new, and were the overhangs of a major debt crisis in 1998-2002, which was linked to the 1997 Asian Financial Crisis, and severely weakened its economy, leaving it vulnerable to external shocks.

Interestingly, through all the ups and downs, and after the IMF’s mishandling of the Asian Financial Crisis, the Argentinian/IMF plan still followed the well-worn playbook of “targeting budget surplus”. It begs the question: Are we missing something that the IMF sees in continually pursuing austerity measures?

The fallacious sovereign debtor/creditor argument.

There is logic behind debt restructuring by improving the budget balance of course. In return for creditors’ “patience”, the debtor has to “meet halfway” by showing commitment to agreed repayment terms.

However there is little reason to extrapolate such an analysis from individuals, to sovereign nations, and believe it will work just the same. Aside from the fact that there are many more stakeholders to consider, sovereign entities’ “rights” and concerns are not equivalent to those of individuals.

If anything, Argentina was one example of how the focus on debt restructuring, especially on “austerity”, had not guaranteed good outcomes. And that was after Argentina had, by 2016, honoured its debt commitments from the debt crisis of 1998-2002.

Faulty assumptions on Austerity.

In that painful intervening period for Argentina, a storm was brewing for Greece as well in the 2010s. Things eventually came to a head, at least for then Greek finance minister, Yanis Varoufakis, in 2015.

Accordingly, and leaving out the details of the Grexit crisis which you can read about here, he wasn’t about to “sell” Greece to the Euro Group’s whims by simply agreeing to steep budget cuts and tax hikes.

And that was where the story got really interesting: If similar austerity measures were never quite the runaway success, why keep insisting on them as immediate measures?

Aside from the usual argument that large budget cuts and tax hikes would cause immense hardship on the Greeks and channel unhelpful support to “Grexit”, Varoufakis powerfully pointed out something that wasn’t often talked about: It is naïve to imagine that steep tax hikes guaranteed higher tax revenue.

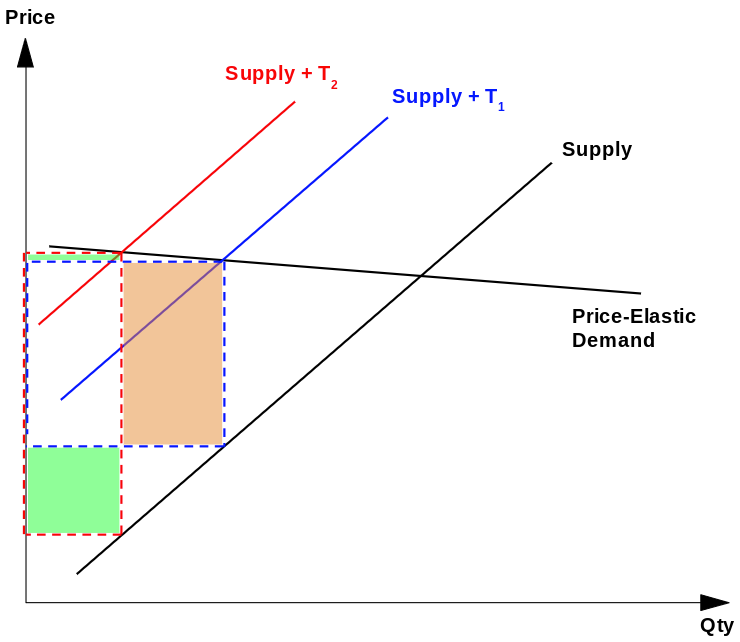

To see why, consider the effect of a tax hike on a given good in Greece, using a simple demand-supply model, and with a simple tax rate applied per unit sold. Due to economic hardship, people would generally be highly sensitive to price increases, meaning the demand for goods would be price elastic:

As we can see, the effect of a tax hike in this case is to actually decrease, rather than increase the tax revenue! The gain in tax revenue (area in green) is actually outweighed by the loss in tax revenue (area in brown), when the tax rate was hiked from T1 to T2.

If the demand-supply diagram is too much economics mumbo-jumbo for you, you may consider also that the tax revenue (T) in our example, is derived by the product of the tax rate (t) and the quantity of goods sold (q):

T = t.q

Both t and q share an inverse relationship: When t increases, people will cut back purchases, causing q to fall. It is self-explanatory therefore that for T to increase, t must increase at a faster rate than the decrease in q. But who is to guarantee that outcome?

Surely the Euro Group is smarter than that?

At this point, I thought it couldn’t be that the Euro Group’s estimation would be this off. The discussion above is intuitive and widely recognised, and should therefore be factored into the working models used to estimate the appropriate tax measures.

Unfortunately for them (but fortunately for readers), Varoufakis pointed out that the easiest way to find out at that time, was to introduce a crazy tax hike to the working model, which should cause demand, and tax revenue to collapse.

Instead, the working model output a correspondingly crazy tax revenue increase, which was proof that an assumption of static goods demand had been built into the recommendations for tax hikes to the suffering Greeks.

Key takeaways.

I was flabbergasted.

I am not a fan of utilising “Economics concepts” at every opportunity – I have seen enough to know that most phenomena have pluralistic explanations behind them, be it for social, psychological, political or even geographical reasons.

Nonetheless, Economics concepts such as price elasticities do have use cases as appropriate illustrations of various economic outcomes for given specific conditions.

While Varoufakis’ account is almost certainly biased and there were push-backs against his accounts, his claims were very convincing explanations to why history kept repeating itself when it came to austerity tax hikes as the go-to solution for many instances, despite the sufferings wrought to untold numbers of people around the world.

It beggars belief that such blunt calculations could be made by appointed technocrats, and actually applied to economies. But then the world is littered by many such stories of less-than-appropriate actions, so this one may not be that surprising after all.

Hello. Such a nice post! I’m really appreciate it. It will be great if you’ll read my first article on SF!)

LikeLike

These are truly great ideas in regarding blogging.You have touched some nice factors here.Any way keep up wrinting.

LikeLike