Few events and talking points can cause a storm greater than a combination of the by-now-much-anticipated annual Budget Announcement and HDB housing policies.

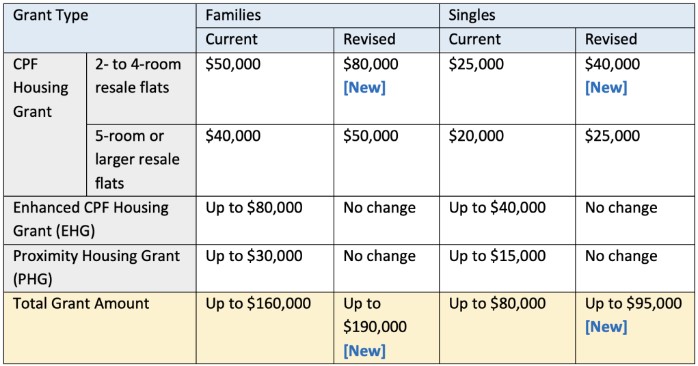

In particular, the increase in HDB housing grants for first-time buyers purchasing resale homes has become quite the lightning rod for criticisms.

Here’s a summary to recap that change:

Will HDB resale house prices go up?

The blowback from the ground came quick and furious. Most of these howls posited that higher grant monies paid out to the first-time house buyer will result in higher resale house prices. As the intuition goes, airdropping money to house buyers would increase their purchasing power and allow sellers more scope for price-gouging.

Or is it? Still others have claimed that “resale HDB flat sellers are unlikely to raise prices for first-time buyers despite higher grants“. So the jury might still be out on this after all.

We can try to use demand-supply theory to reconcile the probable outcomes.

Consider that the HDB resale grant for first-time buyers is in fact a lump-sum direct subsidy. That’s high-brow speak for a fixed one-time payout from the government to the buyer, at the point of transaction.

It is worth pointing out that for “A” and “IB” level Economics, most of the discourse focuses on indirect subsidies, where the payout goes to the seller instead. You can check out my previous detailed explanation about its mechanics and economic impact here.

In any case, direct subsidies continued to be taught at schools, albeit at a cursory level for most part. So a discussion about it won’t be too out of the place at all.

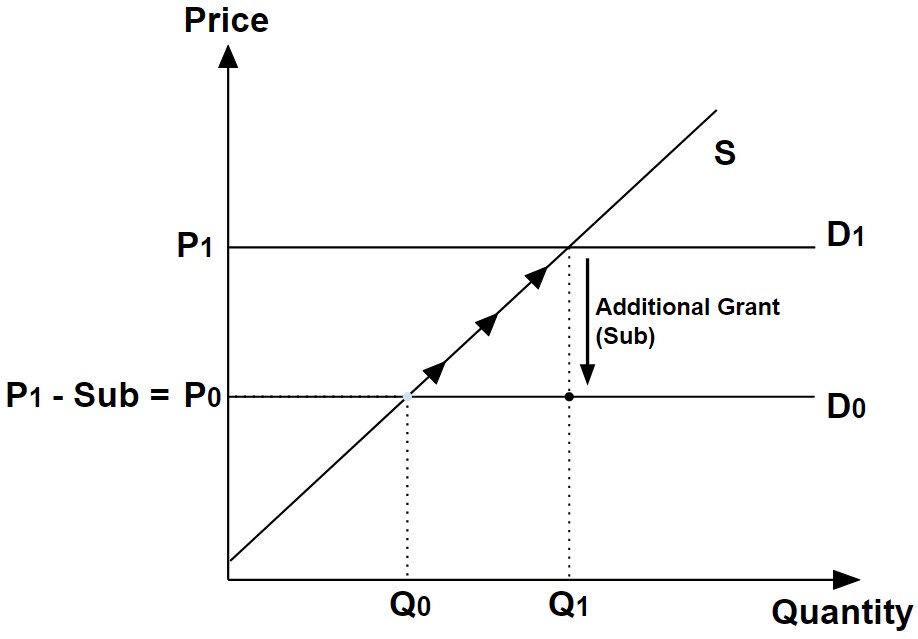

Here’s what a visual representation of the HDB resale grant looks like in the resale house market:

With the implementation of the additional grant (which acts as a direct subsidy to the existing market), the perceived willingness and ability of the buyer to buy the resale house increases at every quantity level from D0 to D1 .

This then results in the equilibrium price of resale house increasing from P0 to P1 , at least in the market for first-time buyers.

The Buyer’s Price vs the Market Price

A higher market price per se isn’t such a bad thing for the first-time resale house buyer who receives the additional subsidy. That’s because as long as the subsidy exceeds the increase in market price, the house buyer will still enjoy cost savings.

We can then express the condition where the buyer will never be worse-off as:

New Market Price – Previous Market Price ≤ Additional Grant

And in the context of the demand-supply diagram above:

P1 – P0 ≤ Sub

Which we can rewrite as:

P1 – Sub ≤ P0

Given that the buyer’s out-of-pocket price is P1 – Sub, and the previous market price is P0 , this actually makes sense: The buyer will benefit from the additional subsidy as long as the new out-of-pocket price falls below the previous one.

More intriguingly, it is possible to prove graphically that such a condition will always hold, by exploring edge cases based on the permissible limits of the respective slopes of the demand and supply.

Case 1: The buyer is willing to pay at only 1 price.

That’s another way of saying that the demand is now perfectly price elastic:

As a result of the buyer’s willingness to purchase at only one price, the market price must be P1 = P0 + Sub .

With the additional grant, his out-of-pocket cost remains unchanged at P1 – Sub = P0 , which leaves him no better/worse off than before.

Case 2: The buyer is willing to pay any price.

In other words, the demand is now perfectly price inelastic:

Since the buyer is now ambivalent to the price he has to pay for the house, and we assume that the market price of the house becomes solely dependent on the seller’s willing sale-price only, then the market price of the house must remain unchanged at P0 since there were no changes to the supply.

Therefore, the buyer reaps the full benefit of the additional grant, paying the buyer’s price of P1 – Sub = P0 – Sub .

Case 3: The seller is willing to sell at only 1 price.

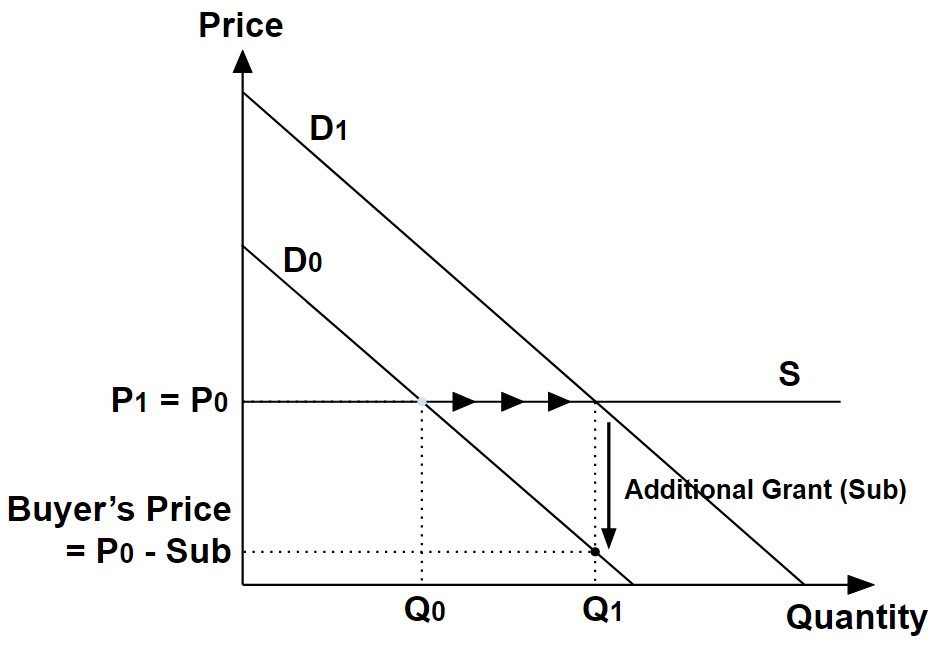

The supply is now perfectly price elastic:

As the seller offers only one price, the selling price will remain the same: P1 = P0 .

Accordingly, the buyer’s price is then P1 – Sub = P0 – Sub , which, similar to Case 2, implies that the buyer enjoys the full benefit of the additional grant.

Case 4: The seller is willing to sell at any price.

This describes a case where the seller is unprepared to increase or decrease the quantity sold in the market and therefore accepts any sale price (i.e. the supply is perfectly price inelastic):

As the buyers are now more willing and able to pay for what essentially is the same number of houses sold in the market, the market price will rise by the same amount as the subsidy, effectively negating any cost savings that the additional grant should have granted to the buyer, since P1 – Sub = P0 .

With all that has been said and done, we can see that no matter the characteristics of the HDB resale market, within the bounds of the demand-supply framework, the buyer will be at least no worse off in the most extreme scenarios.

This implies that the target of the subsidy (first-time resale house buyers) will very likely benefit from the additional grant with lower out-of-pocket price.

Why are so many upset over the additional grant for first-timer buyers?

Judging by how some observers have given their opinions that house prices may increase as a direct consequence of the additional subsidies, and yet others think that the effect will be muted at best, it is clear that few can claim to predict the actual outcome.

On the other hand, the demand-supply model for the resale house market for first-time buyers as above, generally agrees with these observations in that, post-addition in grants to first-time resale house buyers:

- P1 ≥ P0 ; and

- Q1 ≥ Q0

The combination of both effects will likely increase the price of resale houses to the wider market because:

- The price increase in the first-time resale house buyer’s market will likely have a contagion effect to the wider resale house market; and

- The increase in quantity sold in the first-time resale house buyer’s market will likely reduce the supply for other sub-resale house markets given the relative inelasticity to the resale house supply pool.

And if there’s something we know about uncertainties to the somewhat-expected price increase, it is that loss aversion will serve to further inflate negative sentiments about the already-inflamed housing affordability discourse.

Not least because any price increase in the resale HDB house market is perceived by the general public to enrich the sellers at the expense of taxpayers.

So what do you think?

Is the targeted additional subsidy the way to go for helping to improve the affordability of HDB resale houses for first-time buyers?

Within the constraints of having to wait out the mitigating effects of the ongoing increase in supply of new houses, are there better ways in reassuring the general public about the affordability of houses in Singapore?

Let me know by typing your comments below!